Voici les principaux résultats eu égard aux propositions des actionnaires lors des assemblées annuelles de 2016. Ce sont des données relatives aux grandes sociétés publiques américaines.

Je crois qu’il est intéressant d’avoir le pouls de l’évolution des propositions des actionnaires, car cela révèle l’état de la gouvernance dans les grandes corporations ainsi que le niveau d’activités des activistes.

Cet article, publié par Elizabeth Ising, associée et co-présidente de la « Securities Regulation and Corporate Governance practice group » de la firme Gibson, Dunn & Crutcher, est paru sur le forum de HLS hier.

L’auteure présente les résultats de manière très illustrée, sans porter de jugement.

Personnellement, je constate un certain essoufflement des propositions des actionnaires en 2016. Dans plusieurs cas cependant les entreprises ont remédié aux lacunes de gouvernance.

Vos commentaires sont recherchés et appréciés.

Bonne lecture !

Shareholder Proposal Developments During the 2016 Proxy Season

This post provides an overview of shareholder proposals submitted to public companies for 2016 shareholder meetings, including statistics, notable decisions from the staff of the Securities and Exchange Commission on no-action requests, and information about litigation regarding shareholder proposals. All shareholder proposal data in this post is as of June 1, 2016 unless otherwise indicated.

Submitted Shareholder Proposals

Overview

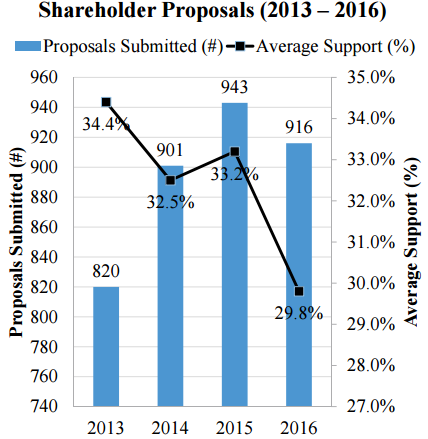

Fewer Proposals Submitted: According to ISS data, shareholders have submitted fewer shareholder proposals for 2016 meetings than they did for 2015 meetings.

However, the number of proposals submitted for 2016 meetings is still higher than the approximate number of proposals submitted for 2014 and 2013 meetings.

Support Declined: Average support for shareholder proposals is at its lowest in four years. [1]

Only 14.5% of proposals (61 proposals) voted on at 2016 meetings received support from a majority of votes cast, compared to 16.7% of proposals (75 proposals) at 2015 meetings.

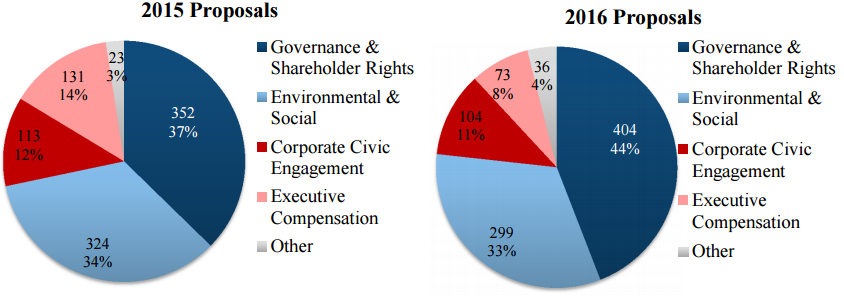

Focus Remains on Governance

Across five broad categories of shareholder proposals, the approximate number of proposals submitted for 2016 meetings (as compared to 2015 meetings) was as follows:

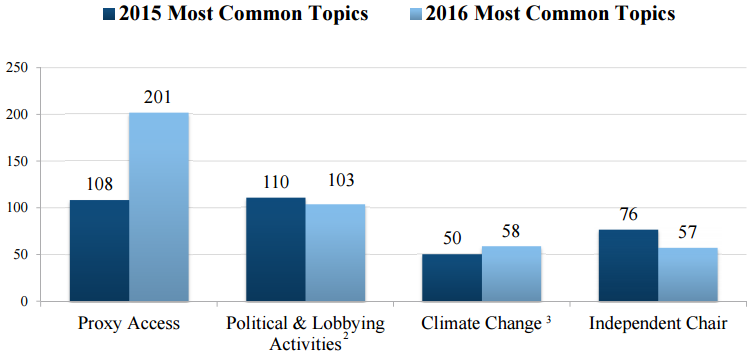

For the second year in a row, governance & shareholder rights proposals were the most frequently submitted proposals, largely due to the yet again unprecedented number of proxy access shareholder proposals submitted (201 proposals (or 21.9% of all proposals) submitted for 2016 meetings versus 108 proposals submitted for 2015 meetings).

Proxy Access Proposals Continue to Dominate

The most common 2016 shareholder proposal topics, along with the approximate numbers of proposals submitted and as compared to the most common 2015 shareholder proposal topics, were [2] [3]:

Most Active Proponents

Chevedden & Co.: As is typically the case, John Chevedden and shareholders associated with him (including James McRitchie) submitted by far the greatest number of shareholder proposals—approximately 227 for 2016 meetings.

Most of these proposals (66.6%) have either been voted on or are pending. Twenty-three percent have been omitted after obtaining relief through the SEC no-action process; another 7% have ultimately not been included in proxy statements or have not been properly presented at the meeting; and only 3.1% of these proposals have been withdrawn.

By way of comparison, shareholder proponents withdrew approximately 19.2% of the proposals submitted for 2016 meetings, up from approximately 17% of the proposals withdrawn for 2015 meetings.

NYC Pension Funds: This season once again saw a large number of proposals submitted by the New York City Comptroller on behalf of five New York City pension funds, which submitted or cofiled at least 79 proposals (as compared to 86 proposals submitted for 2015 meetings), including approximately 72 proxy access proposals, [4] as part of the Comptroller’s continuation of its “Boardroom Accountability Project” for 2016.

Only 34.6% of these proposals have either been voted on or are pending; most (55.6%) of these proposals have been withdrawn. The remainder (9.8%) have been omitted or not otherwise included in proxy statements.

Other Proponents

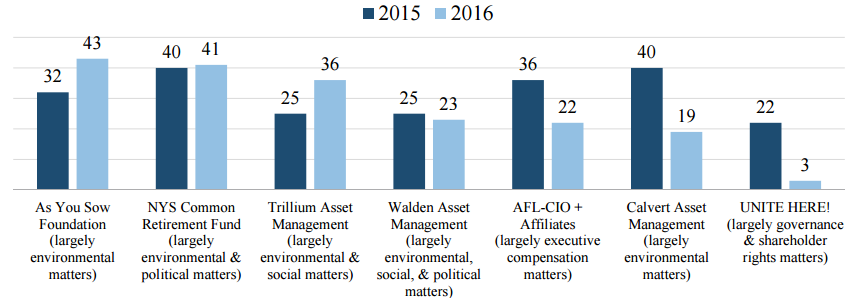

Some of the Same Players (But Not Everyone Returned in 2016): As was true for 2015 meetings, with the exception of Calvert Asset Management and UNITE HERE!, several of the same proponents that were reported to have submitted or co-filed at least 20 proposals each for 2015 meetings, did so again for 2016 meetings:

Same Subject Areas: As reflected in the chart above, the focus of these proponents remained largely consistent with their focus for 2015 meetings.

Public Pension Funds: In addition to the New York City and New York State pension funds, several other state pension funds submitted shareholder proposals as well:

California State Teachers’ Retirement System (18 proposals, largely focused on governance matters and climate change);

Connecticut Retirement Plans and Trust Funds (14 proposals, largely focused on governance, social, and political matters);

City of Philadelphia Public Employees Retirement System (10 proposals, largely focused on political and lobbying matters);

North Carolina Retirement Systems (two board diversity proposals);

California Public Employees’ Retirement System (one proxy access proposal); and

Firefighters’ Pension System of Kansas City, Missouri (one majority voting in director elections proposal).

Shareholder Proposal Voting Results

Majority Voting in Director Elections Receives the Highest Support

The following are the principal topics addressed in proposals that received high shareholder support at a number of companies’ 2016 meetings:

Majority Voting in Uncontested Director Elections: Ten proposals voted on averaged 74.2% of votes cast, compared to 76.6% in 2015;

Amendment of Bylaws or Articles to Remove Antitakeover Provisions: Two proposals voted on averaged 70.6% of votes cast, compared to 79% in 2015;

Board Declassification: Three proposals voted on averaged 64.5% of votes cast, compared to 72.6% in 2015;

Elimination of Supermajority Vote Requirements: Thirteen proposals voted on averaged 59.6% of votes cast, compared to 53.0% in 2015;

Proxy Access: Fifty-eight proposals voted on averaged 48.7% of votes cast, compared to 54.6% in 2015;

Shareholder Ability to Call Special Meetings: Sixteen proposals voted on averaged 39.6% of votes cast, compared to 44.4% in 2015; and

Written Consent: Thirteen proposals voted on averaged 43.4% of votes cast, compared to 39.4% in 2015.

Majority Votes on Shareholder Proposals

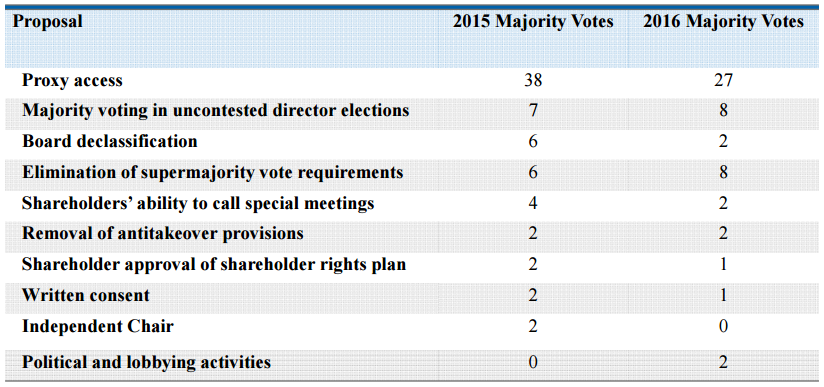

The table below shows the principal topics addressed in proposals that received a majority of votes cast at a number of companies:

* * *

The complete publication is available here.

Endnotes:

[1] As of June 1, 2016, voting results were available through the ISS databases for a total of 422 proposals. As a matter of practice, the vast majority of shareholder proposals submitted to companies for shareholder meetings are submitted under Rule 14a-8 rather than pursuant to companies’ advance notice bylaws. However, because the ISS data does not indicate whether a shareholder proposal has been submitted under Rule 14a-8 or under a company’s advance notice bylaws, it is possible that the ISS data includes voting results for shareholder proposals not submitted pursuant to Rule 14a-8. This discrepancy is likely to account for only a very small number of proposals.

(go back)

[2] Includes all corporate civic engagement proposals, except proposals relating to charitable contributions (one submitted as of June 1, 2016 for 2016 meetings).

(go back)

[3] Includes proposals relating to (i) reports on climate change; (ii) greenhouse gas emissions; and (iii) climate change action (i.e., proposals requesting increasing return of capital to shareholders in light of climate change risks). Note that climate change is a subtopic of the environmental and social category of proposals.

(go back)

[4] NYC Comptroller, Boardroom Accountability Project, available at http://comptroller.nyc.gov/boardroom-accountability/ (last visited June 1, 2016).

(go back)

Une réflexion sur “Résultats eu égard aux propositions des actionnaires lors des assemblées annuelles de 2016”