Selon David A. Katz et Laura A. McIntosh, associés de la firme Wachtell, Lipton, Rosen & Katz, les entreprises américaines ont franchi un point de non-retour eu égard à l’acceptation de la contribution de la diversité à la profitabilité des sociétés.

En effet, il est de plus en plus acquis que l’accroissement de la diversité a des effets positifs sur les deux rôles majeurs du conseil d’administration : (1) la surveillance (oversight) et (2) la création de valeur des entreprises.

Ce court article, publié sur le site du Harvard Law School Forum, décrit les progrès réalisés dans la mise en œuvre de la diversité sur les CA et montre que les entreprises en sont à un tournant dans ce domaine.

Bonne lecture ! Vos commentaires sont appréciés.

Corporate Governance Update: Prioritizing Board Diversity

In what has been called a “breakout year” for gender diversity on U.S. public company boards, corporate America showed increasing enthusiasm for diversity-promoting measures during 2016. Recent studies have demonstrated the greater profitability of companies whose boards are meaningfully diverse. In many cases, companies have collaborated with investors to increase the number of women on their boards, and a number of prominent corporate leaders have publicly encouraged companies to prioritize diversity. The Business Roundtable, a highly influential group of corporate executives, recently released a statement that explicitly links board diversity with board performance in the two key areas of oversight and value creation. Likewise, a group of corporate leaders—including Warren Buffett, Jamie Dimon, Jeff Immelt, and Larry Fink, among others—published their own “Commonsense Principles of Corporate Governance,” (discussed on the Forum here) an open letter highlighting diversity as a key element of board composition.

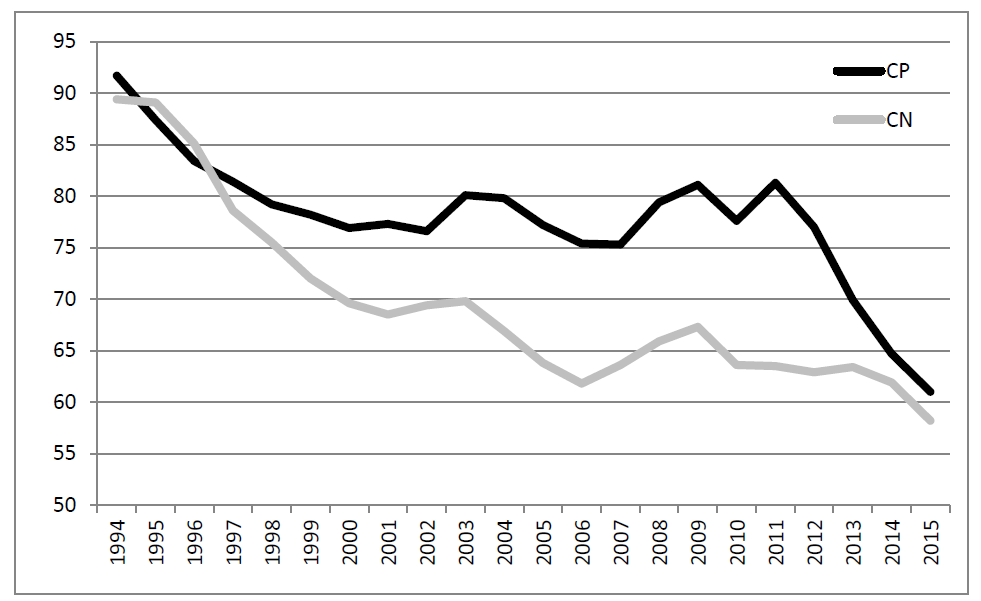

Momentum toward gender parity on boards is building, particularly in the top tier of public corporations. Pension funds from several states have taken strong stances intended to encourage meaningful board diversity at the 25 percent to 30 percent level. Last year, then-SEC Chair Mary Jo White cited the correlation of board diversity with improved company performance and identified board diversity as an important issue for the Commission, signaling that it may be a priority for regulators going forward. Boards should take note of the evolving best practices in board composition and look for ways to improve, from a diversity standpoint, their candidate search, director nomination, and board refreshment practices. We recommend that boards include this issue as part of an annual discussion on director succession, similar to the annual discussion regarding CEO succession.

Diversity and Performance

A board of directors has two primary roles: oversight and long-term value creation. This year, the Business Roundtable released updated governance guidelines (discussed on the Forum here) that link a commitment to diversity to the successful accomplishment of both goals. Its 2016 guidelines include a statement on diversity that reads, in part, “Diverse backgrounds and experiences on corporate boards … strengthen board performance and promote the creation of long-term shareholder value.” In a statement accompanying the guidelines, Business Roundtable leader John Hayes noted that a “diversity of thought and perspective … adds to good decision-making” and enables “Americans, as well as American corporations, to prosper.” Board success and competence thus is recast to include diversity as an essential element rather than as an afterthought or as a concession to special interests.

Similarly, the “Commonsense Principles of Corporate Governance” (discussed on the Forum here) outlined over the summer by a group of corporate leaders highlights diversity on boards—multi-dimensional diversity—and correlates that diversity with improved performance. The signers of the principles, including an activist investor, a pension plan, and various chief executives, stated unequivocally in their accompanying letter that “diverse boards make better decisions.” A consensus seems to be emerging among corporate leaders that, as stated by the Business Roundtable, boards should include “a diversity of thought, backgrounds, experiences, and expertise and a range of tenures that are appropriate given the company’s current and anticipated circumstances and that, collectively, enable the board to perform its oversight function effectively.” With regard to oversight, a recent study by Spencer Stuart and WomenCorporateDirectors Foundation (discussed on the Forum here) found that female directors generally are more concerned about risks, and are more willing to address them, than are their male colleagues. Boards should, where possible, develop a pipeline of candidates whose career paths are enabling them to acquire the relevant professional expertise to be valuable public company directors in their industry.

In order to promote diversity in board composition, boards should become familiar with director search approaches to identify qualified candidates that would not otherwise come to the attention of the nominating committee. Executive search firms, public databases, and inquiries to organizations such as 2020 Women on Boards are a few of the ways that boards can find candidates that may be beyond their typical field of view. Organizations exist to help companies in their recruitment efforts. Crain’s Detroit Business, for example, has compiled a database of qualified female director candidates in Michigan, who are invited to apply and are vetted for inclusion. Boards may wish to commit to including individuals with diverse backgrounds in the pool of qualified candidates for each vacancy to be filled.

The Future of Diversity

In 2016, shareholder proposals on board diversity met with increased success. The numbers are still small: Nine proposals made it onto the ballot last year, nearly double the total in 2015 and triple the total in 2014. Nonetheless, support reached unprecedented levels in certain cases: A diversity proposal—which was not opposed by management—at FleetCor Technologies received over 70 percent shareholder support. Another diversity proposal—which was opposed by management—at Joy Global received support from 52percent of the voting shares (though the proposal did not pass due to abstentions). Diversity proposals are generally supported by the proxy advisory firms, including Institutional Shareholder Services and Glass Lewis.

Perhaps more significantly, shareholder proposals in several cases resulted in increased board diversity without ever coming to a vote. The pension fund Wespath submitted proposals this year seeking to increase diversity at three major corporations, and in each case withdrew the proposals when the subject companies agreed to add women to their boards. A spokesperson for Wespath stated that the fund had privately communicated their desire for increased diversity and had filed proposals as a “last resort” to spur change.

In a similar effort, CalSTRS recently submitted 125 letters to boards at California corporations whose boards had no women directors; in response, 35 of the companies appointed female board members. CalSTRS has indicated that if its private approaches are unsuccessful, it will proceed with shareholder proposals. The Wespath and CalSTRS examples are valuable for boards. Listening to investors, being responsive, and staying out in front of issues to forestall shareholder proposals is far better than reacting to frustrated investors who feel compelled to resort to extreme measures to get corporate attention. It is also greatly preferable to a situation in which activist investors press for legislative actions such as quotas or other mandatory board composition requirements, as we have seen in other countries.

2017 is likely to be a year in which progress toward greater board diversity significantly accelerates. Indeed, it is becoming clear that gender diversity—if not gender parity—one day will be a standard aspect of board composition. While the process of realizing that future should not be artificially or counterproductively hastened, it should be welcomed as a state of affairs that will be beneficial to all corporate constituents and, beyond, to the greater good of U.S. business and American culture.