Voici l’évaluation que les membres de la haute direction se font de l’efficacité des administrateurs de leurs sociétés.

L’article a été publié par Paul DeNicola et Leah Malone, directeurs à Governance Insights Center, PricewaterhouseCoopers LLP, et Paul Washington, directeur exécutif au ESG Center du The Conference Board.

La tendance est de tenir compte de cette composante dans le processus d’évaluation des membres du conseil des sociétés cotées en bourses.

Vous trouverez, ci-dessous, la version anglaise de la publication dans le Forum du Harvard Law School.

Qu’en pensez-vous ?

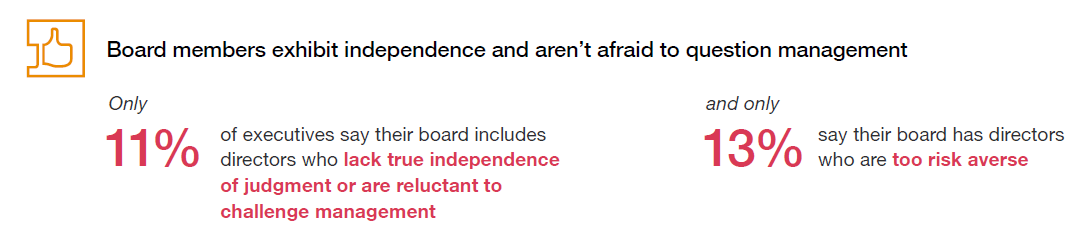

It’s rare for corporate directors to receive candid feedback from their company’s management teams. The nature of the board of directors’ oversight role makes it an uncomfortable proposition. But the view of the boardroom from the C-suite can be illuminating—and surprising. That is why PwC and The Conference Board asked more than 550 public company C-suite executives to share their perspective on their boards’ overall effectiveness, their strengths and weaknesses, and their readiness to tackle some of the biggest challenges facing companies today.

The results were clear: most executives say board performance is falling short of the mark.

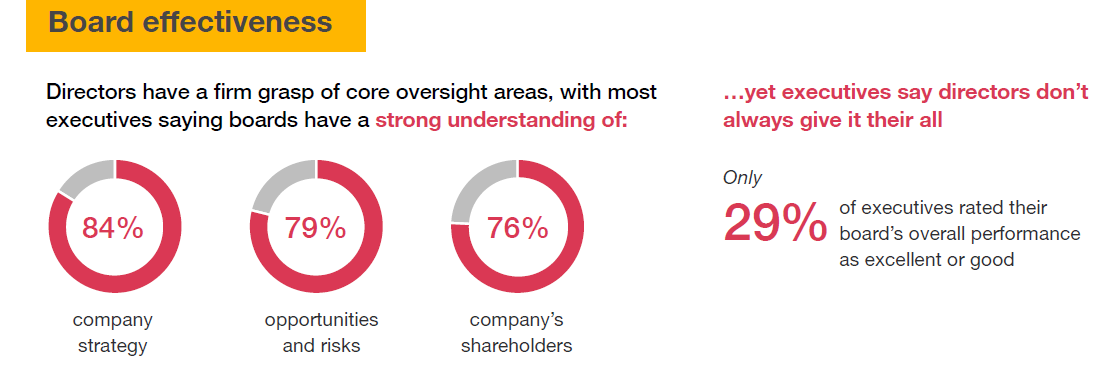

This isn’t to say that executives were uniformly negative in their assessment. Many agreed that directors had a firm grasp of core matters such as the company’s strategy, the risks and opportunities before it, and the priorities of its shareholders.

Yet most executives had a less positive view of overall performance. Asked to rate the effectiveness of their boards, just 29% of executives gave directors a grade of good or excellent. Most (55%) said that they were doing a fair job overall, and a small minority (16%) graded their effectiveness as poor.

While this is not exactly a failing grade, it isn’t a resounding endorsement either. Many executives said that boards lack preparedness, put too little time into their duties, and have insufficient expertise in some emerging topics like environmental, social, and governance (ESG) matters and cybersecurity, which are high priorities for lawmakers, regulators, and other stakeholders.

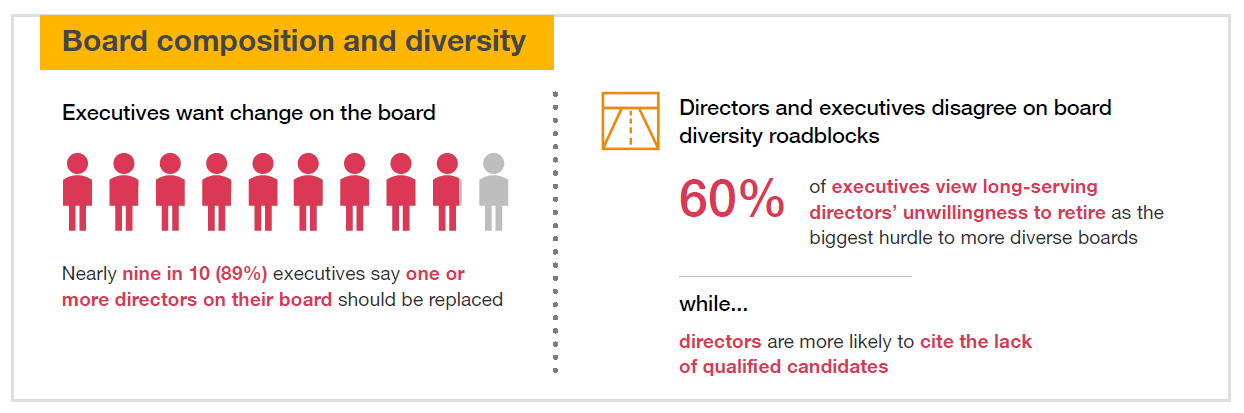

Many executives question whether the directors on their boards have the right skills, experience, and background to help steer companies through today’s uncertain climate. Nearly nine out of 10 executives (89%) say that at least one of their company’s board members needs to be replaced. Executives point to the reluctance of long-tenured directors to retire, in particular, as an impediment to board diversity.

COVID-19 has been an all-hands-on-deck moment for corporations, placing unprecedented demands on both executives and boards. As companies continue to refine their strategies for coping with the pandemic’s ongoing disruptions, the survey shows that boards still have work to do in the eyes of their management teams.

These survey findings point to some critical areas for improvement. Both directors and executives alike may benefit from reflecting on these findings with an eye to strengthening their partnership, which is crucial to the success of any company.

Key Findings

The complete publication, including footnotes, is available here.