La scène de l’activisme actionnarial a drastiquement évolué au cours des vingt dernières années. Ainsi, la perception négative de l’implication des « hedge funds » dans la gouvernance des organisations a pris une tout autre couleur au fil des ans.

Les fonds institutionnels détiennent maintenant 63 % des actions des corporations publiques. Dans les années 1980, ceux-ci ne détenaient qu’environ 50 % du marché des actions.

L’engagement actif des fonds institutionnels avec d’autres groupes d’actionnaires activistes est maintenant un phénomène courant. Les entreprises doivent continuer à perfectionner leur préparation en vue d’un assaut éventuel des actionnaires activistes.

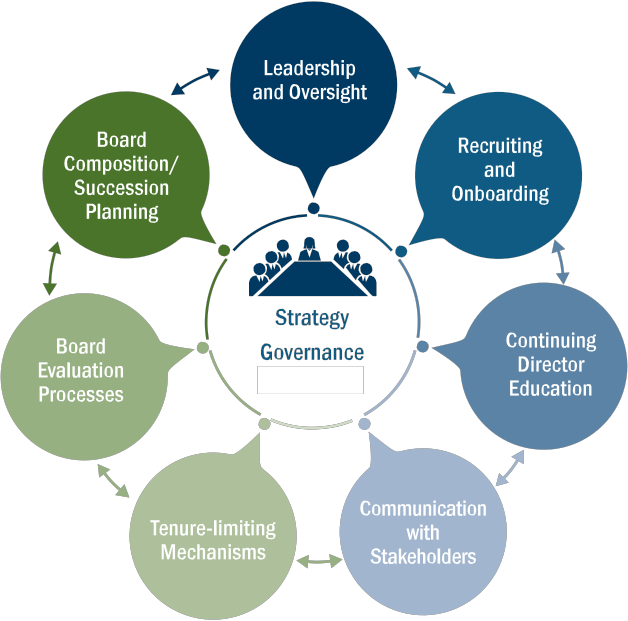

L’auteure présente dix activités que les entreprises doivent accomplir afin de décourager les activistes, les incitant ainsi à aller voir ailleurs !

Voici la liste des étapes à réaliser afin d’être mieux préparé à faire face à l’adversité :

J’espère vous avoir sensibilisé à l’importance de la préparation stratégique face à d’éventuels actionnaires activistes.

Shareholder activism is a powerful term. It conjures the image of a white knight, which is ironic because these investors were called “corporate raiders” in the 1980s. A corporate raider conjures a much different image. As much as that change in terminology may seem like semantics, it is critical to understanding how to deal with proxy fights or hostile takeovers. The way someone is described and the language used are crucial to how that person is perceived. The perception of these so-called shareholder activists has changed so dramatically that, even though most companies’ goals are still the same, the playbook for dealing with activists is different than the playbook for corporate raiders. As such, a corresponding increase in the number of activist encounters has made that playbook required reading for all public company officers and directors. In fact, there have been more than 200 campaigns at U.S. public companies with market capitalizations greater than $1 billion in the last 10 quarters alone.

It’s not just the terminology concerning activists that has changed, though. Technologies, trading markets and the relationships activists have with other players in public markets have changed as well. Yet, some things have not changed.

It’s not just the terminology concerning activists that has changed, though. Technologies, trading markets and the relationships activists have with other players in public markets have changed as well. Yet, some things have not changed.

The 1980s had arbitrageurs that would often jump onto any opportunity to buy the stock of a potential target company and support the plans and proposals raiders had to “maximize shareholder value.” Inside information was a critical component of how arbs made money. Ivan Boesky is a classic example of this kind of trading activity—so much so that he spent two years in prison for insider trading, and is permanently barred from the securities business. Arbs have now been replaced by hedge funds, some of which comprise the 10,000 or so funds that are currently trying to generate alpha for their investors. While arbitrageurs typically worked inside investment banks, which were highly regulated institutions, hedge funds now are capable of operating independently and are often willing allies of the 60 to 80 full time “sophisticated” activist funds. Information is just as critical today as it was in the 1980s.

Institutions now occupy a far greater percentage of total share ownership today, with institutions holding about 63% of shares outstanding of the U.S. corporate equity market. In the 1980s, institutional ownership never crossed 50% of shares outstanding. Not only has this resulted in an associated increase of voting power for institutions by the same amount, but also a change in their behavior and posture toward the companies in which they invest, at least in some cases. Thirty years ago, the idea that a large institutional investor would publicly side with an activist (formerly known as a “corporate raider”) would be a rare event. Today, major institutions have frequently sided with shareholder activists, and in some cases privately issued a “Request for Activism”, or “RFA” for a portfolio company, as it has become known in the industry.

It seldom, if ever, becomes clear as to whether institutions are seeking change at a company or whether an activist fund identifies a target and then seeks institutional support for its agenda. What is clear is that in today’s form of shareholder activism, the activist no longer needs to have a large stake in the target in order to provoke and drive major changes.

For example, in 2013, ValueAct Capital held less than 1% of Microsoft’s outstanding shares. Yet, ValueAct President, G. Mason Morfit forced his way onto the board of one of the world’s largest corporations and purportedly helped force out longtime CEO Steve Ballmer. How could a relatively low-profile activist—at the time at least—affect such dramatic change? ValueAct had powerful allies, which held many more shares of Microsoft than the fund itself who were willing to flex their voting muscle, if necessary.

The challenge of shareholder activism is similar to, yet different from, that which companies faced in the 1980s. Although public markets have changed tremendously since the 1980s, market participants are still subject to the same kinds of incentives today as they were 30 years ago.

It has been said that even well performing companies, complete with a strong balance sheet, excellent management, a disciplined capital allocation record and operating performance above its peers are not immune. In our experience, this is true. When the amount of capital required to drive change, perhaps unhealthy change, is much less costly than it is to acquire a material equity position for an activist, management teams and boards of directors must navigate carefully.

Below are 10 building blocks that we believe will help position a company to better equip itself to handle the stresses and pressures from the universe of activist investors and hostile acquirers, which may encourage the activists to instead knock at the house next door.

Building Block 1: Be Prepared

Develop a written plan before the activist shows up. By the time a Schedule 13-D is filed, an activist already has the benefit of sufficient time to study a target company, develop a view of its weaknesses and build a narrative that can be used to put a management team and board of directors on the defensive. Therefore, a company’s plan must have balance and must contemplate areas that require attention and improvement. While some activists are akin to 1980s-style corporate raiders with irrational ideas designed only to bump up the stock over a very short period, there are also very sophisticated activists who are savvy and have developed constructive, helpful ideas. A company’s plan and response protocol need to be well thought through and in place before an activist appears. In some cases, the activist response plan can be built into a company’s strategic plan.

The plan needs inclusion and buy-in from the board of directors and senior management. Some subset of this group needs to be involved in developing the plan, not only substantively, but also in the tactical aspects of implementing the plan and communicating with shareholders, including activists, if and when an activist appears.

This preparatory building block extends beyond simply having a process in place to react to shareholder activism. It should complement the company’s business plan and include the charter and bylaws and consideration of traditional takeover defense strategies. It should provide for an advisory team, including lawyers, bankers, a public relations firm and a forensic accounting firm. We believe that the plan should go to a level of detail that includes which members of management and the board are authorized by the board to communicate with the activist and how those communications should occur.

Building Block 2: Promote Good Shareholder Relations with Institutions and Individual Shareholders

If the lesson of the first block was “put your own house in order,” then the second lesson is, “know your tenants, what they want, and how they prefer to live in your building.” This goes well beyond the typical investor relations function. This is where in-depth shareholder research comes into play. We recommend conducting a detailed perception study that can give boards and management teams a clear picture of what the current shareholder base wants, as well as how former and prospective shareholders’ perceptions of the company might differ from the way management and the board see the company itself.

In a takeover battle or proxy contest, facts are ammunition. Suppositions and assumptions of what management thinks shareholders want are dangerous. It is critical to understand how shareholders feel about the dividend policy and the capital allocation plans, for example. Understand how they view the executive compensation or the independence of the board. Do not assume. Ask candidly and revise periodically.

Building Block 3: Inform, Teach and Consult with the Board

Good governance is not something that can be achieved in a reactive sort of manner or when it becomes known that an activist is building a position. Without shareholder-friendly corporate governance practices, the odds of securing good shareholder relations in a contest for control drops significantly and creates the wrong optics.

There are governance issues that can cause institutional shareholders to act, or at least think, akin to activists. Recently, there have been various shareholder rebellions against excessive executive compensation packages—or say-on-pay votes. In fact, Norges, the world’s largest sovereign wealth fund, has launched a public campaign targeting what it views as excessive executive compensation. The fund’s chief executive told the Financial Times that, “We are looking at how to approach this issue in the public space.” He is speaking for an $870 billion dollar fund. The way those votes are cast can mean the difference between victory and defeat in a proxy contest.

Building Block 4: Maintain Transparent Disclosure Practices

While this building block relates to maintaining good shareholder relations, it also recognizes that activists are smart, well informed, motivated and relentless. If a company makes a mistake, and no company is perfect, the activist will likely find it. Companies have write-downs, impairments, restatements, restructurings, events of change or challenges that affect operating performance. While any one of these events may invite activist attention, once a contest for control begins, an activist will find and use every mistake the company ever made and highlight the material ones to the marketplace.

A company cannot afford surprises. One “whoops” event can be all it takes to turn the tide of a proxy vote or a hostile takeover. That is why it is critical to disclose the good and the bad news before the contest begins rather than during the takeover attempt. It may be painful at the time, but with a history of transparency, the marketplace will trust a company that tells them the activist is in it for its own personal benefit and that the proposal the activist is making will not maximize shareholder value, but will only increase the activist’s short-term profit for its investors. Developing that kind of trust and integrity over time can be a critical factor in any contest for corporate control, especially when research shows that the activist has not been transparent in its prior transactions or has misled investors prior to or after achieving its intended result.

When a company has established good corporate governance policies, has been open and transparent, has financial statements consistent with GAAP and effective internal control over financial reporting and knows its shareholder base cold, what is the next step in preparing for the challenge of an activist shareholder?

Building Block 5: Educate Third Parties

Prominent sell-side analysts and financial journalists can, and do, move markets. In a contest for corporate control, or even in a short slate proxy contest, they can be invaluable allies or intractable adversaries. As with the company’s shareholder base, one must know the key players, have established relationships and trust long before a dispute, and have the confidence that the facts are on the company’s side. But winning them over takes time and research, and is another area where an independent forensic accounting firm can be of assistance.

For example, when our client, Allergan, was fighting off a hostile bid from Valeant and Pershing Square, we identified that Valeant’s “double-digit” sales growth came from excluding discontinued products and those with declining sales from its calculation. This piece of information served as key fodder for journalists, who almost unanimously sided against Valeant for this and other reasons. Presentations, investor letters and analyst days can make the difference in creating a negative perception of the adversary and spreading a company’s message.

Building Block 6: Do Your Homework

Before an activist appears, a company needs to understand what vulnerabilities might attract an activist in the first place. This is where independent third parties can be crucial. Retained by a law firm to establish the privilege, they can do a vulnerability assessment of the company compared to its peers.

This is a different sort of assessment than what building block two entails, essentially asking shareholders to identify perceived weaknesses. Here, a company needs to look for the types of vulnerabilities that institutional shareholders might not see—but that an activist surely will. When these vulnerabilities such as accounting practices or obscure governance structures are not addressed, an activist will use them on the offensive. Even worse are the vulnerabilities that are not immediately apparent. In any activist engagement, it is best to minimize surprises as much as possible.

Building Block 7: Communicate With the Activist

Before deciding whether to communicate, know the other players.

This includes a deep dive into the activist’s history—what level of success has the activist had in the past? Have they targeted similar companies? What strategies have they used? How do they negotiate? How have other companies reacted and what successes or failures have they experienced?

If the activist commences a proxy contest or a consent solicitation, turn that intelligence apparatus on the slate of board nominees the activist is proposing. Find out about their vulnerabilities and paint the full picture of their business record. Do they know the industry? Are they responsible fiduciaries? What is their personal track record? These are important questions that investigators can help answer.

Armed with information about the activist and having consulted with management, the board has to decide whether to communicate with the activist, and if so, what the rules of the road are for doing so. What are the objectives and goals and what are the pros and cons of even starting that communication process? If a decision is made to start communications with the activist, make sure to pick the time to do so and not just respond to what the media hype might be promoting. Poison pills can provide breathing room to make these determinations.

Always keep in mind that communications can lead to discussions, which in turn can lead to negotiations, which may result in a deal.

Before reaching a settlement deal, a company must be sure to have completed the preceding due diligence. More companies seem to be choosing to appease activists by signing voting agreements and/or granting board seats. Although this will likely buy more time to deal with the activist in private, it may simply delay an undesirable outcome rather than circumvent the issue. Whether or not the company signs a voting agreement with the activist, management and the board of directors should know the activist’s track record and current activities with other companies in great detail as the initial step in considering whether to reach any accommodation with the activist.

Building Block 8: Understand the Role of Litigation

Most of the building blocks thus far have involved making a business case to the marketplace and supporting that case with candid communications. But in many activist campaigns—especially the really adversarial ones—there will come a time when the company needs to make its case to a court or a regulator or both.

As with other building blocks, litigation goes to one of the most valuable commodities in a contest for corporate control: TIME. In most situations, the more time the target has to maintain the campaign, the better. The company’s legal team needs to work with the forensic accountants to understand and identify issues that relate to the activist’s prior transactions and business activities, while ensuring that the company is not living in a glass house when it throws stones. Armed with the facts, lawyers will do the legal analysis to determine whether the activist has complied with or broken state, federal or international law or regulation. If there are causes of action, then one way to resolve them is to litigate.

Building Block 9: Factor in Contingencies and Options

Contingencies can include additional activists, M&A and small issues that can become big issues. This building block is about understanding the environment in which the company is operating.

For example, are there hedge funds targeting the same company in a “wolfpack”, as the industry has coldly nicknamed them? If two or more hedge funds are acting in concert to acquire, hold, vote or dispose of a company’s securities, they can be treated as a group triggering the requirement to file a Schedule 13-D as such. Under certain circumstances, the remedy the SEC has secured for violating Section 13(d) of the Williams Act is to sterilize the vote of the shares held by the group’s members. So, if there is evidence indicating that funds are working together which have not jointly filed a Schedule 13-D, the SEC may be able to help. Or better yet, think about building block eight and litigate.

In the case of a hostile acquisition, consider whether there is an activist already on the board of the potential acquirer? Has the activist been a board member in prior transactions? If so, what kind of fiduciary has that activist shown himself to be?

Another contingency is exploring “strategic alternatives.”

Building Block 10: Understand the Role of Regulators

Despite the passage of the Dodd-Frank Act, regulators today may be less inclined to intervene in these kinds of issues than they were 30 years ago.

When an activist is engaging in questionable or illegal practices, contacting regulators should be considered. But this requires being proactive.

The best way to approach the regulators is to present a complete package of evidence that is verified by independent third parties. Determine the facts, apply legal analysis to those facts and have conclusions that show violations of the law. Do not just show one side of the case; show both sides, the pros and the cons of a possible violation. Why? Because if the package is complete and has all the work that the regulator would want to do under the circumstances, two things will happen. First, the regulator will understand that there is an issue, a potential harm to shareholders and the public interest which the regulator is sworn to protect. Second, the regulator will save time when it presents the case for approval to act.

Using forensic accountants before and when an activist appears is one of the major factors that can assist companies today and also help the lawyers who are advising the target company. If other advisors are conflicted, the company needs a reputable, independent third party who can help the company ascertain facts on a timely basis to make informed decisions, and if the determination is made to oppose the activist, make the case to shareholders, to analysts, to media, to regulators and to the courts.

Each of these buildings blocks is important. While they have remained mostly the same since the 1980s, tactics, strategies and the marketplace have changed. Even though activists may appear to act the same way, each is different and each activist approach has its own differences from all the others.

Endnotes

1FactSet, SharkRepellent.(go back)

2FactSet, SharkRepellent.(go back)

3The Wall Street Journal, Federal Reserve and Goldman Sachs Global Investment Research.(go back)