Aujourd’hui, je vous présente la gouvernance des entreprises vue sous l’angle de la prééminence de la raison d’être économique ET sociale.

André Coupet et Philippe Carpentier ont accepté d’agir à titre d’auteurs invités sur mon blogue en gouvernance, et je les remercie énormément. La perspective exprimée dans leur modèle innovant est très inspirante pour les gestionnaires prêts à envisager une nouvelle façon de concevoir la gouvernance et le management des entreprises, en tenant compte des parties prenantes.

Leur article fait partie intégrante de l’ouvrage publié récemment par André Coupet « Vers Une Entreprise Progressiste, le modèle pour basculer dans un capitalisme humaniste au service des parties prenantes » (1).

Après avoir exercé le métier de conseil en stratégie à Montréal et à Paris, au sein du Groupe SECOR, André Coupet* se concentre sur le modèle de l’entreprise progressiste. Élaboré en collaboration avec le Groupement des chefs d’entreprise du Québec et des think tanks français, ce modèle s’inscrit dans la raison d’être de l’auteur : « Inciter les chefs d’entreprise à mettre leur organisation au service d’un monde meilleur ».

Philippe Carpentier** est associé et conseiller stratégique de la firme Brio Conseils pour laquelle il réalise, depuis plusieurs années, des transformations d’entreprises complexes, en collaboration étroite de hauts dirigeants. Ses interventions touchent notamment des restructurations, des expansions géographiques, des fusions et des acquisitions, de nouveaux positionnements, la création ou le repositionnement d’unités d’affaires, le changement de leadership, la nouvelle gouvernance, etc.

Bonne lecture. Vos commentaires sont les bienvenus !

GOUVERNANCE DE L’ENTREPRISE PROGRESSISTE

par

André COUPET* et Philippe CARPENTIER**

De plus en plus de dirigeants sont aujourd’hui convaincus que la maximisation de la valeur au seul bénéfice des actionnaires a créé d’immenses déséquilibres économiques et sociaux dans nos sociétés tout en ne garantissant pas l’utilisation optimale des ressources disponibles sur la planète.

Désormais, beaucoup d’entre eux s’intéressent à la RSE ou aux nouveaux modèles d’entreprise relevant de la « Purpose Economy » (2) aux États-Unis, ou du phénomène B-CORP présent non seulement aux États-Unis, mais aussi au Canada et en Europe, ou encore du récent mouvement des « Entreprises à Mission » en France.

Stimulants, ces modèles sont toutefois peu diserts sur le thème de la stratégie et surtout celui de la Gouvernance, sujet délicat puisqu’il s’agit de définir qui détient le pouvoir et comment celui-ci s’exercera. Nous proposons ci-après une nouvelle façon de concevoir la gouvernance, cette proposition ne pouvant se comprendre qu’en revisitant le modèle de l’Entreprise Progressiste, présenté initialement dans la Revue Gestion (3) à l’automne 2016. S’appuyant sur le vécu de femmes et d’hommes d’affaires sollicités par André COUPET au sein de divers think tanks, Terra Nova et Entreprise et Progrès en France, et le Groupement des Chefs d’Entreprise du Québec, ce modèle innovant est ancré dans une réalité vécue par des entreprises voulant faire autrement tout en étant parfaitement rentables (4).

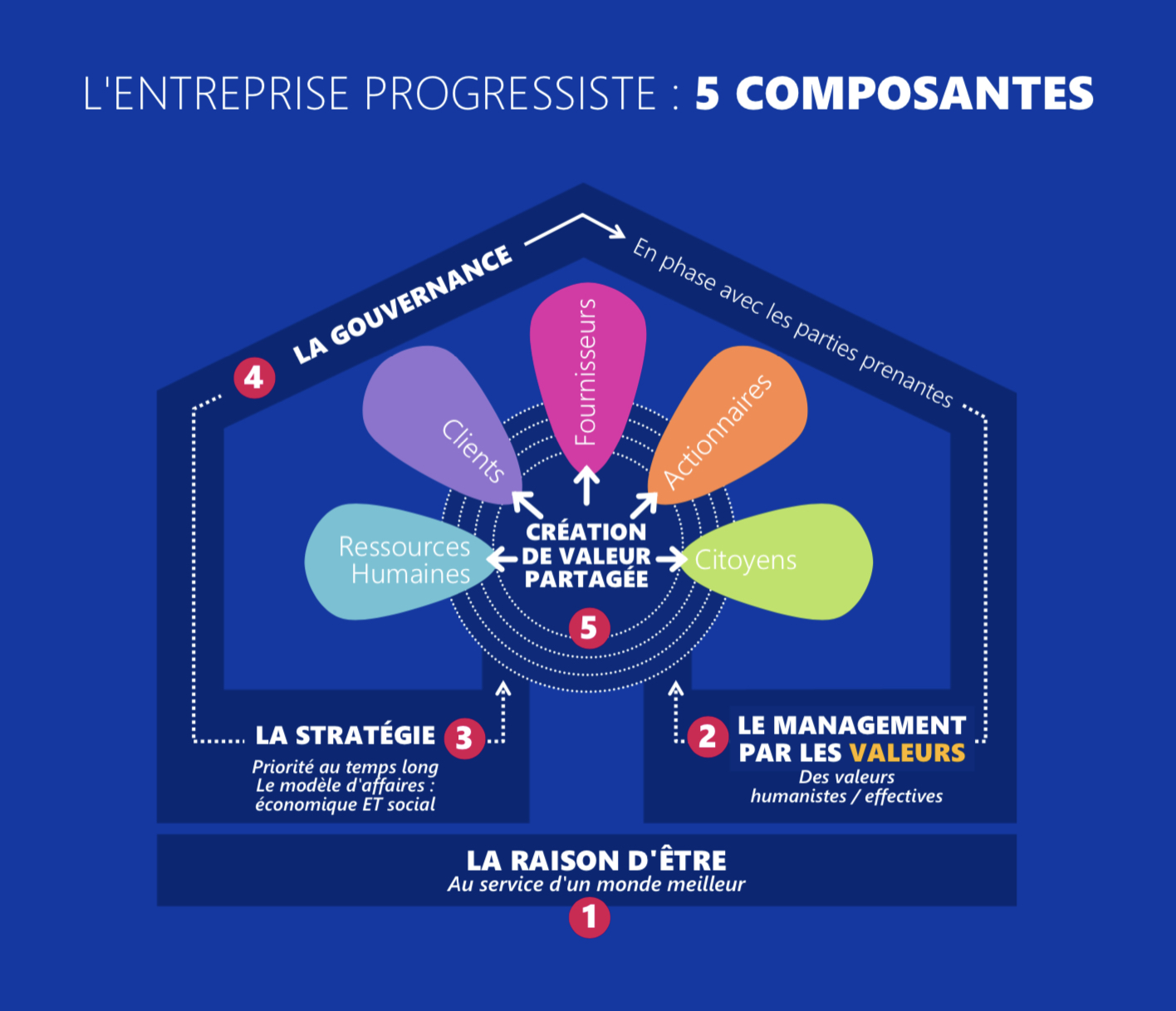

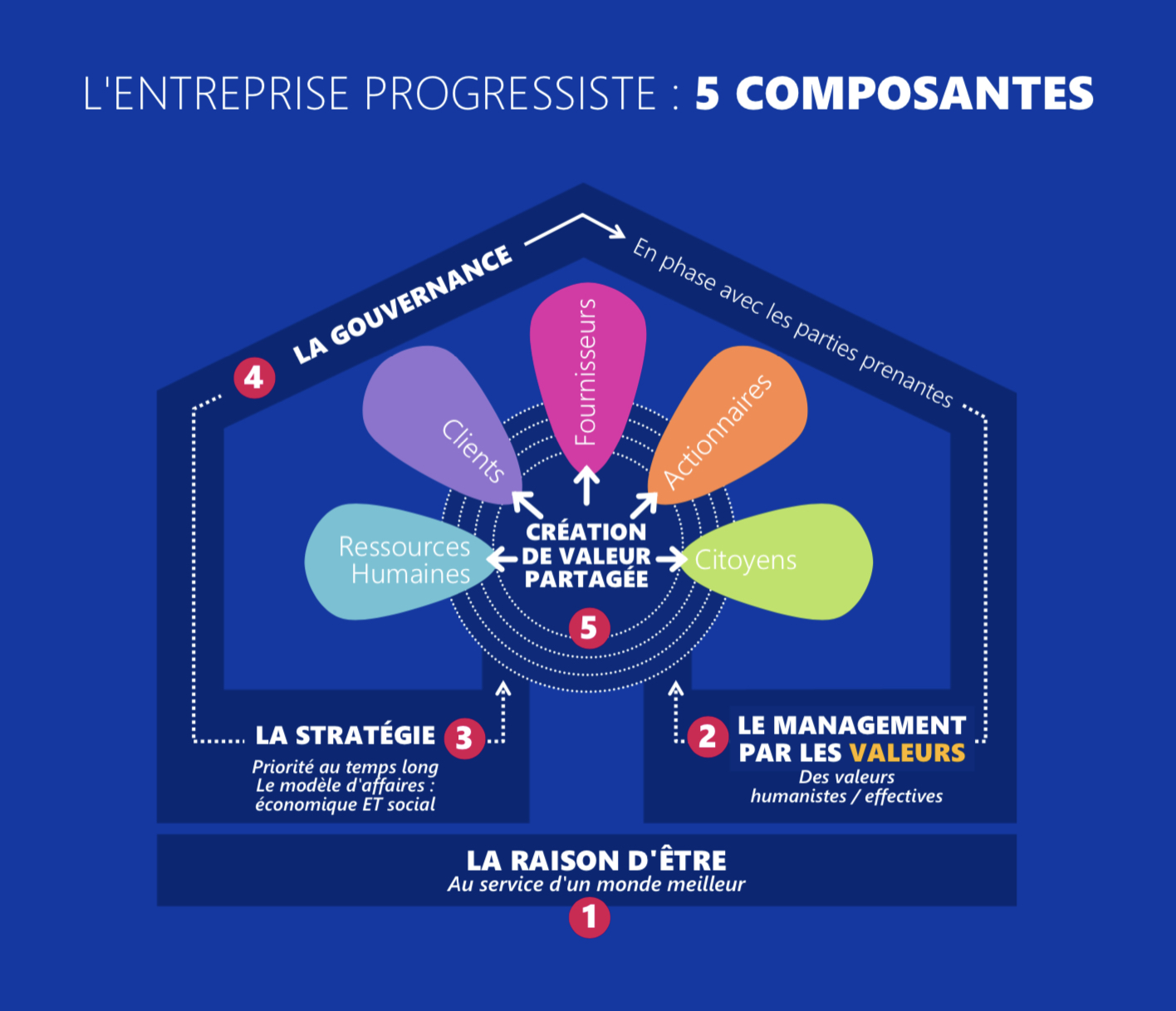

L’entreprise progressiste : Cinq Composantes interreliées

L’entreprise progressiste allie l’économie et l’humanisme dans sa raison d’être, dans son éthique, dans sa stratégie et dans sa gouvernance. Bien commun, l’entreprise progressiste se veut profitable : le profit permet de créer de la valeur pour l’ensemble de ses parties prenantes ; il est un moyen au service d’une fin (« Purpose before profit »). Volontaire, l’entreprise progressiste se différencie de ses concurrentes par sa contribution à la Société, contribution positive apportant du sens aux clients de l’entreprise et à tous les acteurs et partenaires qui participent à la création de valeur.

Concrètement, le modèle de l’entreprise progressiste se structure autour de 5 composantes :

1— Une Raison d’être économique ET sociétale

La raison d’être d’une entreprise définit ce pourquoi celle-ci existe, ce qu’elle apporte de fondamentalement utile à ses clients Et à la société, et ce, si possible, de façon distinctive. Au-delà des offres, de la technologie et même du domaine d’intervention, la raison d’être cible une préoccupation reliée à la Société. Au domaine choisi s’ajoute une contribution à la construction d’un monde meilleur.

Danone résume ainsi sa raison d’être en une phrase : « apporter la santé par l’alimentation au plus grand nombre » ; la formule « Du bonheur à l’intérieur et à l’extérieur » que véhicule PRANA, un distributeur canadien d’aliments biologiques et certifiés sans OGM, illustre bien cette vision qui va bien au-delà du produit.

2— Des valeurs humanistes

L’éthique d’une entreprise au service du bien commun peut se définir autour des 4 valeurs clés de l’humanisme : le respect, l’équité, l’honnêteté et l’ouverture à l’autre (bienveillance, diversité, altruisme…). Inscrites dans le processus décisionnel, ces valeurs débouchent sur un management participatif, libéré, et sur des modes d’organisation plus horizontaux, plus propices à la mobilisation de tous les acteurs.

3— Une Stratégie intégrée

Il n’y a pas un Plan d’affaires d’un côté avec ses objectifs économiques (Chiffre d’affaires, marge, part de marché…) et une démarche environnementale et sociétale de type RSE de l’autre comme si celle-ci venait corriger, adoucir la stratégie. L’aspect sociétal de la raison d’être est intégré dans le modèle d’affaires en s’inspirant de concepts issus de l’économie circulaire, du commerce équitable ou plus efficacement encore de l’économie de la fonctionnalité qui est centrée sur l’utilité et l’usage du produit plutôt que sur la propriété et l’achat : le manufacturier de voitures se lancera dans la location de voitures ou même l’autopartage.

Une stratégie intégrée débouche naturellement sur une performance globale où le profit et les indicateurs économiques font cause commune avec les indicateurs « sociétaux », du niveau d’engagement des employés à la proportion d’énergie renouvelable utilisée tout au long de la chaîne de valeur en passant par le taux de satisfaction des fournisseurs ou la création d’emplois dans la communauté…

4— Une création de valeur partagée

Traditionnellement, les exercices de définition de la stratégie, qui visent à maximiser le retour aux actionnaires, passent par une « proposition de valeur » attractive, unique si possible, en faveur des clients : Amazon ou Ryan Air font cela très bien sans être des entreprises progressistes puisque les autres parties prenantes, employés, fournisseurs, territoire…, font plutôt l’objet d’une extraction de valeur sans contrepartie.

La stratégie de l’entreprise progressiste définit, non pas une, mais 5 propositions de valeur, une par grande partie prenante : outre les clients, il faut une proposition de valeur pour les employés : promettre — on fait ici référence à la marque employeur — et délivrer un développement des compétences, des évolutions de carrière, des parcours à l’international, des possibilités de prendre des congés sabbatiques ou autres, etc. Pour les fournisseurs, il s’agira de les impliquer dans les processus de définition de la stratégie, d’amélioration de la qualité, d’innovation, dans un partenariat à long terme. Pour le territoire, il s’agira de s’engager sur la création d’emplois, de collaborer avec les universités ou collèges pour ajuster les programmes de formation aux réalités nouvelles, etc. Autant de propositions de valeur attractives qui font que les clients, les étudiants ou les chercheurs d’emplois, les fournisseurs, les territoires… voudront travailler avec cette entreprise qui crée de « la valeur partagée ».

5— Une Gouvernance en cohérence avec l’approche par les parties prenantes

À partir du moment où l’on comprend que l’intérêt à long terme de l’entreprise est de travailler en intelligence et de créer de la valeur avec et pour l’ensemble des parties prenantes, et à partir du moment où l’on reconnaît que les résultats aujourd’hui sont désormais une fonction de 4 facteurs : le talent, le capital, le temps et l’alignement des intérêts de l’écosystème, il devient logique, impératif d’intégrer le talent et les principales parties prenantes dans les instances de gouvernance de l’entreprise. Le système anglo-saxon est peu ouvert à cette idée. En Europe, 13 pays ont déjà adopté des législations qui font entrer les salariés dans les conseils d’administration ; depuis près de 50 ans, l’Allemagne fonctionne plutôt bien, n’est-ce pas ? avec le principe de la codétermination ; les administrateurs salariés étant obligatoirement à égalité avec les administrateurs actionnaires dans les conseils des entreprises de plus de 2000 employés.

À la codétermination nous préférons la TRIDÉTERMINATION, une gouvernance et donc une organisation du CA fondées sur 3 piliers plutôt que deux. Nous préconisons une approche plus ouverte, qui ne se referme pas sur la dialectique capital-travail, plutôt passéiste, peu en phase avec la nécessaire prise en considération du principal facteur de succès qu’est le talent. Or celui-ci ne se loge pas que chez les employés, mais également chez les clients et chez les fournisseurs, lesquels font aujourd’hui de la co-construction de produits ou services avec l’entreprise. Cette opposition capital-travail serait d’ailleurs plus délicate autour de la table du conseil d’administration des entreprises ayant un historique chargé en matière de relations de travail.

Les administrateurs indépendants peuvent constituer la troisième force des conseils et éviter l’éventuelle confrontation évoquée précédemment. Toutefois, aujourd’hui, les administrateurs indépendants, qui sont choisis pour leur compétence, leur parcours, leur sagesse…, n’ont pas de mandat particulier autre que celui de veiller à la conformité des instances et à la pérennité des entreprises, ce qui convient évidemment bien aux actionnaires.

Tout en conservant ces deux responsabilités, on peut demander explicitement aux administrateurs indépendants d’être particulièrement vigilants quant aux intérêts à court et à long terme de toutes les parties prenantes ; ils veilleront notamment à ce que les réalités, les difficultés et les attentes des clients, des fournisseurs, de la Société civile ou du territoire… soient prises en compte. Les administrateurs indépendants existent déjà dans nombre d’entreprises ; hormis le choix des candidats qui sera un peu plus complexe, cette solution est plus simple et surtout dépourvue de tout conflit d’intérêts potentiel contrairement à la proposition parfois suggérée de nommer des administrateurs représentant les clients ou les fournisseurs. Il importe d’ailleurs ici de rappeler que les administrateurs sont tenus de défendre les intérêts de toute l’entreprise, de faire corps avec les décisions du Conseil d’administration, cette instance devant réfléchir et décider dans la sérénité, la discrétion et la solidarité.

Cette remarque s’impose pour éviter toute ambiguïté en ce qui a trait aux administrateurs salariés. Élus par l’ensemble des employés de l’entreprise, le rôle des administrateurs salariés ne doit pas être confondu avec celui d’autres acteurs, syndiqué ou non, membre des instances représentatives du personnel. Le thème des relations de travail, avec tous ses sujets extrêmement concrets concernant la vie de celles et de ceux qui travaillent dans l’entreprise, n’a pas à envahir l’ordre du jour du CA, instance fondamentale pour la pérennité de l’entreprise et centrée en conséquence sur la stratégie. Le dialogue social s’inscrit dans l’opérationnel ; il relève de la direction générale ou de la direction des ressources humaines.

Le CA, acteur clé de la réflexion stratégique

Trop souvent, le CA ne fait qu’approuver et contrôler. Dans l’entreprise progressiste, le CA se réapproprie le temps long et aligne l’entreprise sur sa raison d’être, il s’implique donc avant, pendant et après le choix de la stratégie. Le CA est au cœur du processus de réflexion stratégique, dans sa formulation, dans les décisions auxquelles il aboutira, dans le contrôle de sa mise en œuvre et dans l’examen des résultats.

Dans l’entreprise progressiste, le CA et l’équipe de direction ne sont pas isolés l’un de l’autre, voire en opposition dans des calculs pour savoir qui a le plus d’ascendant sur l’autre… C’est pourquoi, par exemple, pour préparer la stratégie, les membres du CA et de l’équipe de direction se retrouvent conjointement lors de 1 ou 2 journées de réflexion et de partage où les statuts de mandants et de mandataires sont mis de côté pour faciliter les échanges.

En étant composé de représentants des parties prenantes et en se concentrant sur la stratégie, le CA trouve toute sa place : il est le décideur ultime, pleinement responsable. Et il devient inutile de mettre en place, à côté du CA, comme certains le proposent, un comité des parties prenantes, qui ne peut être qu’un assemblage hétéroclite, sans pouvoir, consultatif, permettant au CA traditionnel de se défausser, d’esquiver ses responsabilités à l’égard des parties prenantes autres que les actionnaires.

LA GOUVERNANCE, la clé du changement de paradigme

On reproche souvent aux entreprises de ne faire que du verdissement d’image quand celles-ci se contentent de capitaliser sur l’angoisse écologique des consommateurs en mettant en avant quelques belles initiatives en faveur de l’environnement.

La distinction entre ces entreprises opportunistes et celles qui souhaitent s’inscrire comme des organisations citoyennes, pleinement responsables et soucieuses de la prospérité de toutes les personnes qui, à des degrés divers, dépendent d’elles, se fera au regard de leur stratégie et, ultimement, de leur gouvernance : La Stratégie est-elle intégrée, au service d’une raison d’être porteuse de sens pour la Société, empreinte d’altruisme en lieu et place de la cupidité ? La gouvernance est-elle en phase avec cette ouverture vers tous les acteurs, en harmonie avec son environnement ?

La gouvernance, telle que définie ici, fait que le modèle de l’entreprise progressiste va bien au-delà de la RSE traditionnelle ; elle constitue la clé de voûte d’un capitalisme nouveau, le capitalisme des parties prenantes (5).

Notes et références

1 — COUPET A. « Vers une entreprise progressiste, le modèle pour basculer dans un capitalisme humaniste au service des parties prenantes », Éditions Paris Québec Inc., décembre 2020 ; disponible sur http://www.entrepriseprogressiste.com.

2— HURST A. « The Purpose Economy », Elevate, 2014.

3— COUPET A. et DORMAGEN E. « Au-delà de la RSE — l’entreprise progressiste », Gestion, vol.41, n° 3, automne 2016, p.25-29.

4— COUPET A. et JEZEQUIEL M. « L’Éthique créatrice de valeur partagée », Gestion, vol.43, n° 4, hiver 2018, p.81-83.

5— COUPET A. et LEMARCHAND A. « Vers un capitalisme des parties prenantes », La Croix, 14 janvier 2019.

Les auteurs :

* André Coupet est licencié en Sciences économiques de l’Université de Paris et diplômé MBA de l’Université de Sherbrooke, André Coupet a exercé pendant plus de 30 ans le métier de conseil en stratégie, notamment les stratégies « client », à Montréal et à Paris. Il se concentre aujourd’hui sur l’émergence d’un nouveau modèle économique pour les entreprises. Il a ouvert et dirigé la filiale parisienne du Groupe canadien SECOR. Homme de conviction, il écrit régulièrement dans des journaux économiques ou des revues universitaires, notamment la Revue Gestion HEC Montréal, et s’implique dans des forums de réflexion progressiste conformément aux valeurs qu’il défend.

** Philippe Carpentier est associé et conseiller stratégique de la firme Brio Conseils pour laquelle il réalise, depuis plus de 20 ans, des transformations d’entreprises complexes, en collaboration étroite de hauts dirigeants. Ses interventions touchent notamment des restructurations, des expansions géographiques, des fusions et des acquisitions, de nouveaux positionnements, la création ou le repositionnement d’unités d’affaires, le changement de leadership, la nouvelle gouvernance, etc.

.jpg?width=2400&name=taille%20conseil%20administration%20(1).jpg)

Why Board Members Decide To Step Down

Why Board Members Decide To Step Down