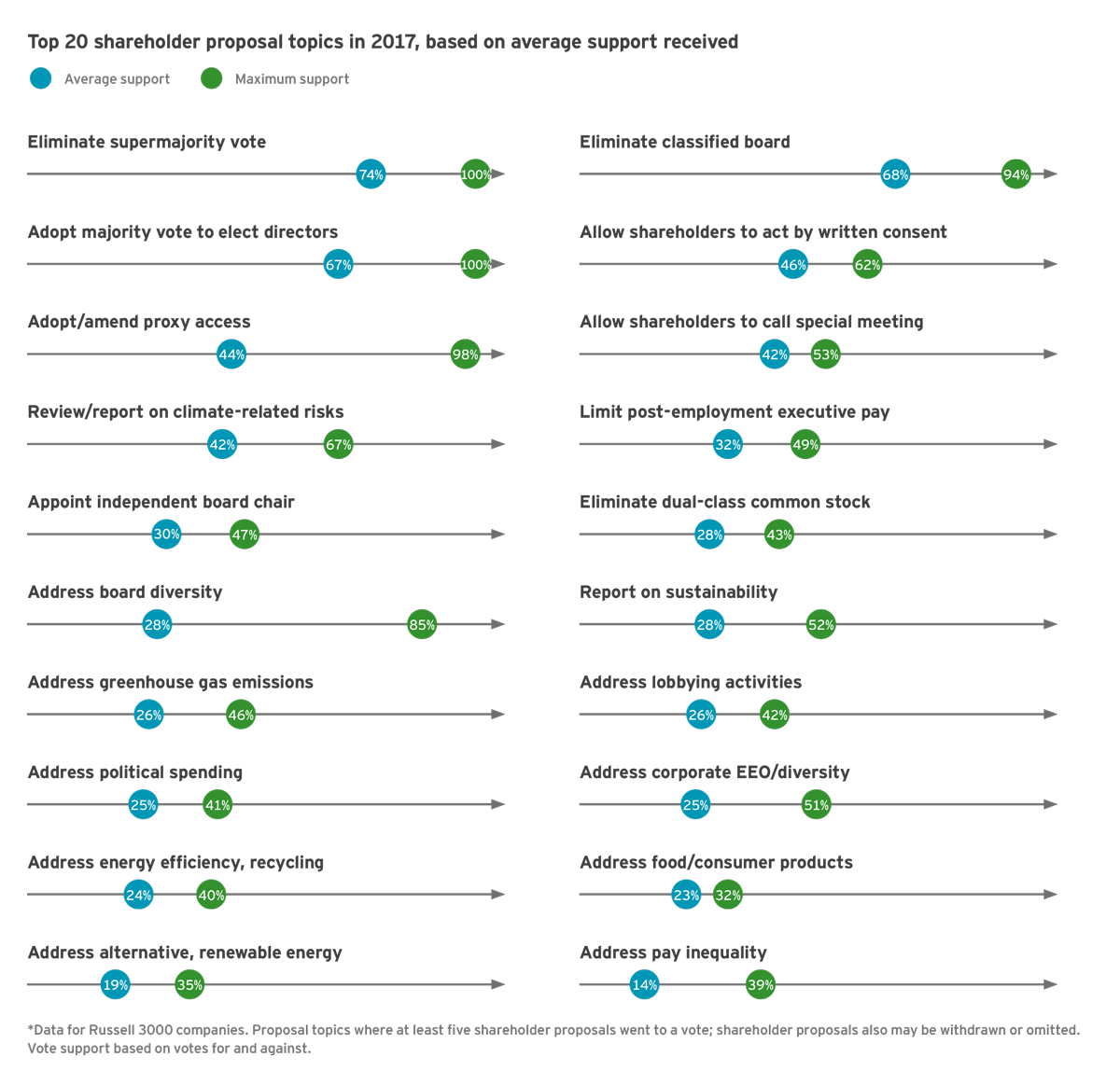

Clarion calls for regulating dual-class stock have become a common occurrence. For example, the Council of Institutional Investors (“CII”) has called upon the NYSE and Nasdaq to adopt a rule requiring all companies going public with dual-class shares to include a so-called “sunset provision” in their charter, which would convert the company to a single class of stock after a set period of years. CII has also urged index providers to discourage the inclusion of firms with dual-class structures (and both the S&P Dow Jones and FTSE Russell indices have already done so). Many individual CII members, along with some of the world’s largest mutual funds and other investors, have joined together in the “Framework for U.S. Stewardship and Governance” to take a strong stance against dual class structures.

Proxy advisory services have also announced their opposition to dual-class companies. For example, Institutional Shareholder Services (“ISS”) has announced a plan to recommend against directors at companies with differential voting rights if there are no “reasonable sunset” provisions. Even the SEC’s Investor Advisory Committee has raised its own concerns about dual-class stock companies, calling on the SEC to “devote more resources” to “identify risks” arising out of governance disputes from dual-class structures.

Yet what is the empirical evidence supporting these calls for regulation of dual-class companies? Dual-class companies have existed for nearly a century, going back to the Dodge Brothers’ IPO in 1925 and Ford’s IPO in 1956. Historically, technology companies did not adopt a dual-class capital structure. Rather, until Google’s (now Alphabet) 2004 IPO, most dual-class companies were family businesses, media companies seeking to ensure their publications could maintain journalistic editorial independence, or other companies led by a strong group of insiders. These companies often adopted their dual-class structures to avoid the pressures of having to focus primarily on short-term variations in stock price.

Many of these older dual-class companies were the focus of a seminal 2010 paper that found that dual class firms tend to be more levered and to underperform their single class counterparts, with increased insider cash flow rights increasing firm value and increased insider voting rights reducing firm value.

Since 2010, there have been an increasing number of technology companies going public with dual-class (or multi-class) share structures. Anecdotal evidence is mixed, but the early empirical evidence on the performance of these newer dual-class companies as a group is quite interesting. In particular, though many of these companies have not been public for very long, the limited available data suggests that these newer dual-class companies might even be out-performing single-class structured companies.

For example, MSCI, one of the largest global index providers, recently released a study showing that companies with “unequal voting stocks in aggregate outperformed the market over the period from November 2007 to August 2017.” The study further concluded that excluding these companies “from market indexes would have reduced the indexes’ total returns by approximately 30 basis points per year over [the] sample period.” The differential was even greater in North America, where stocks with unequal voting rights outperformed stocks with the more traditional one-share/one-vote structure by 4.5% annually.

Recent academic research corroborates the outperformance of the newly public companies with dual-class stock. For example, one study concludes that dual-class companies, avoiding short-term market pressures, have more growth opportunities and obtain higher market valuations than matched single-class firms Even with respect to perpetual dual-class stock companies, research shows that these companies, when controlled by a founding family, “significantly and economically” outperform nonfamily firms. Another study maintains that it might be more efficient to give more voting power to shareholders who are better informed, thereby allowing them more influence, and correspondingly less voting power to those who are less informed, including passive index funds. Passive investors would pay a discounted price in exchange for waiving their voting rights.

We have begun our own preliminary research on these issues, with considerations including corporate control, liquidity, capital allocation, “next generation” issues, and using stock as currency for acquisitions and to reward employees. While still in its initial stage, our analysis also raises fundamental questions about how much value shareholders perceive in having voting stock versus non-voting stock in these relatively new to market technology companies. For example, consider Classes A and C of Alphabet, issued through a stock dividend four years ago, which are different only in specific ways, most notably that A has one vote per share and C has none. Atypically, for each of the last three trading days in February, Alphabet’s non-voting class C share, GOOG, had a higher closing market price than its voting class A share, GOOGL. More broadly, since GOOG was introduced on April 3, 2014, the correlation between the two classes’ stock prices is 99.9%, and they have similar stock price standard deviations, betas, trading volume, and short interest.

We believe that it is too early to make a definitive determination from an economic standpoint as to whether having dual-class stock is better or worse for investors in the current market environment, especially for younger companies. Any consideration to limit dual-class stock, including adoption of mandatory sunset provisions, must be based on analysis not anecdotes. It should also recognize the changing nature of public markets, including the following:

- The dominance of shareholder primacy has led boards of single-class companies to feel short-term pressure from shareholders. As no less an authority than Delaware Chief Justice Strine has frequently recognized, boards respond to those who elect them. In today’s world, for most public companies that is a handful of institutional investors, as by 2016 institutional investors owned 70% of all public shares, while just three money managers held the largest stock position in 88% of the companies in the S&P 500. While many of these institutions emphasize that they are long-term holders, directors of companies with high institutional investor ownership continue to feel the pressure to take actions to achieve short-term stock increases. For example, a recent survey of over 1000 directors and C-level executives by McKinsey and the Canadian Pension Plan Investment Board (“CPPIB”) found that nearly 80% of these executives felt “especially pressured” to demonstrate strong financial results in two years or less.

- The changing nature of the public and private capital markets. The increased use by technology companies of dual-class capital structures when entering the public markets must be viewed within the changing nature of both the public and private markets for technology companies. According to the Wall Street Journal, more money was raised in private markets than in public markets in 2017, while the number of public companies continues to decline—the number of public companies has fallen by about half since 1996. SEC Commissioner Clayton (among others) has spoken repeatedly about the problems arising out of the decline in the number of public companies. Limiting the ability of public companies to have different capital structures will certainly impact the decision by some companies about whether or not to go public.

- Dual-class stock and alternative capital structures across the world. Regulators considering how to respond to the growth of dual-class stock should consider the growing acceptance of dual-class stock in markets globally. For example, in recent months both Hong Kong and Singapore have opened their markets to dual-class listings. Many European markets already have rules allowing for dual-class companies or other similar structures that allow companies to focus on longer-term principles as well as non-shareholder constituencies. Even in the U.S., newer markets, such as the Long-Term Stock Exchange, are working to list companies with alternative capital structures, so that companies can focus on building a business, in apparent recognition that surrendering to the current dominance of shareholder primacy may not be the best governance structure for all companies.

For these reasons, we believe that the current effort to mandate some form of one-share one-vote for all public companies in the U.S. is premature. The limited empirical evidence on the technology and emerging growth companies that are the target of these regulations is insufficient to support the adoption of new regulations, as the evidence that is available indicates that the most recent group of dual-class companies may have performed as well, if not better, than those with a single class of stock.

______________________________________

Notes

1 See “Recommendation of the Investor As Owner Subcommittee: Dual-Class and Other Entrenching Governance Structures in Public Companies,” February 27, 2018, available at https://www.sec.gov/spotlight/investor-advisory-committee-2012/iac030818-investor-as-owner-subcommittee-recommendation.pdf.(go back)

2 Paul Gompers, Joy Ishii, and Andrew Metrick, “Extreme Governance: An Analysis of Dual-Class Shares in the United States,” Review of Financial Studies 23, 1051-1087 (2010). See also Ronald Masulis, Cong Wang, and Fei Xie, “Agency Problems at Dual-Class Companies” Journal of Finance64, 1697-1727 (2009).(go back)

3 Dmitris Melas, “Putting the Spotlight on Spotify: Why have Stocks with Unequal Voting Right Outperformed?” MSCI Research, April 3, 2018. The study’s findings are robust to controlling for common factors including country, sector, and style factor exposures.(go back)

4 Bradford Jordan, Soohyung Kim, Nad Mark Liu, “Growth Opportunities, Short-Term Market Pressure, and Dual-Class Share Structure,” Journal of Corporate Finance 41, 304-328 (2016).(go back)

5 See Ronald Anderson, Ezgi Ottolenghi, and David Reeb, “The Dual Class Premium: A Family Affair,” August 2017.(go back)

6 Dorothy Shapiro Lund, “Nonvoting Shares and Efficient Corporate Governance,” Stanford Law Review 71 (forthcoming 2019).(go back)

7 There are also class B shares with 10 votes per share, 92.7% of which are owned by executives Eric Schmidt, Sergey Brin, and Larry Page as of December 31, 2017, representing 56.7% of the total voting power (source: Alphabet 10K).(go back)

8 GOOG also closed higher than GOOGL on March 14, March 16, and March 20, 2018. This is not the first such finding: In 1994, Comcast’s nonvoting shares often sold for more than its voting shares. See Paul Schultz and Sophie Shive, “Mispricing of Dual-Class Shares: Profit Opportunities, Arbitrage, and Trading,” Journal of Financial Economics 98, 524-549 (2010).(go back)

9 For the past four years, GOOG and GOOGL have standard deviations (betas) of 176.6 (1.24) and 177.8 (1.23), respectively. GOOGL is slightly more liquid than GOOG, as GOOGL daily share volume averages 2.3 million shares, while GOOG averages 1.97 million shares. GOOGL and GOOG have short interest of 3.4 million and 3.6 million shares, respectively.(go back)

10 See The Hon. Kara M. Stein, Commissioner, Securities and Exchange Commission, The Markets in 2017: What’s at Stake, February 24, 2017.(go back)

11 See Dominic Barton and Mark Wiseman, Investing for the Long-Term, Harvard Business Review, 2014.(go back)

12 Jean Eaglesham and Coulter Jones, “The Fuel Powering Corporate America: $2.4 Trillion in Private Fundraising,” Wall Street Journal, April 3, 2018.(go back)

______________________________

*David J. Berger is a partner at Wilson Sonsini Goodrich & Rosati; and Laurie Simon Hodrick is Visiting Professor of Law and Rock Center for Corporate Governance Fellow at Stanford Law School, Visiting Fellow at the Hoover Institution, and A. Barton Hepburn Professor Emerita of Economics in the Faculty of Business at Columbia Business School. Related research from the Program on Corporate Governance includes The Untenable Case for Perpetual Dual-Class Stock (discussed on the Forum here) and The Perils of Small-Minority Controllers (discussed on the Forum here), both by Lucian Bebchuk and Kobi Kastiel.