Only 19% of new independent directors are active CEOs, chairs, presidents and chief operating officers, compared with 24% in 2011, 29% in 2006 and 49% in 1998, the first year we looked at this data for S&P 500 companies.

Active executives with financial backgrounds (CFOs, other financial executives, as well as investors and bankers) represent 15% of new independent directors this year, an increase from 12% last year. Another 10% of new directors are retired finance and public accounting executives.

On average, S&P 500 directors have 2.1 outside corporate board affiliations, although most directors aren’t restricted from serving on more.

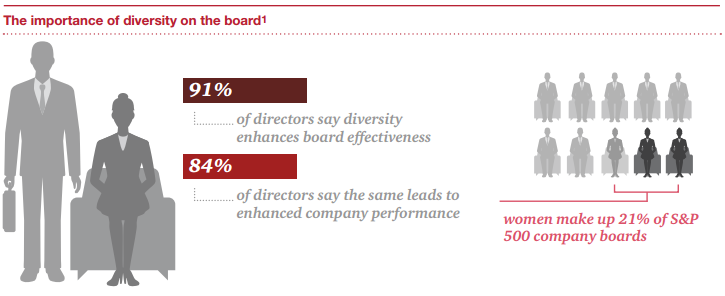

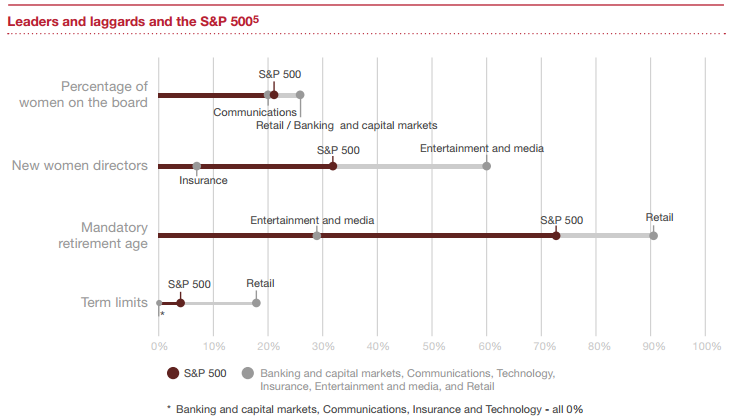

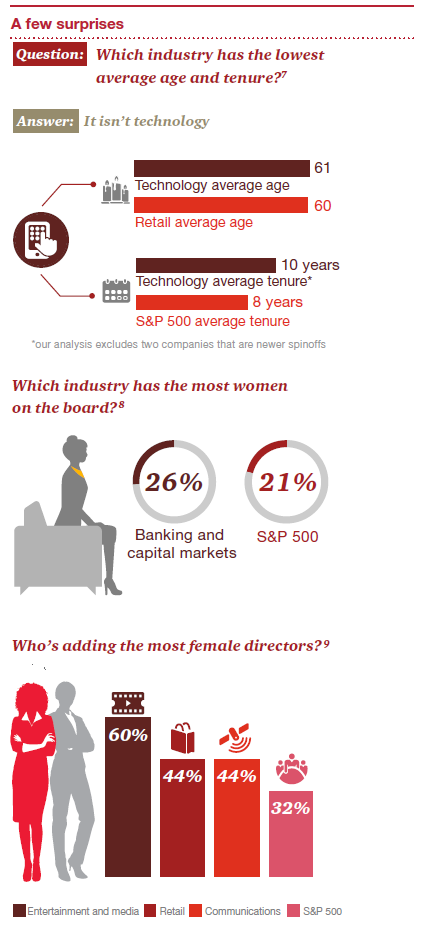

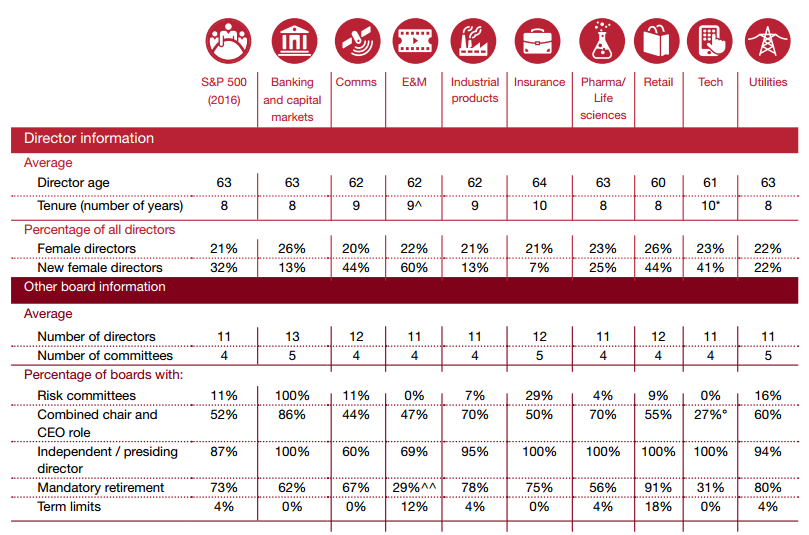

The number of boards with no female directors dropped to the lowest level we have seen; six S&P 500 boards (1%) have no women, a noteworthy decline from 2006, when 52 boards (11%) included no female members. Women now constitute 21% of all S&P 500 directors.

Among the boards of the 200 largest S&P companies, the total number of minority directors has held steady at 15% since 2011. 88% of the top 200 companies have at least one minority director, the same as 10 years ago.

Only 43% of S&P 500 CEOs serve on one or more outside corporate boards in addition to their own board, the same as in 2015. In 2006, 55% of CEOs served on at least one outside board.

Boards met an average of 8.4 times for regularly scheduled and special meetings, up from 8.1 last year and 8.2 five years ago. The median number of meetings rose from 7.0 last year to 8.0.

The average annual total compensation for S&P 500 directors, excluding the chairman’s compensation, is $280,389.

Over time, the compensation mix for directors has evolved, with more stock grants and fewer stock options. Today, stock grants represent 54% of total director compensation, versus 48% five years ago, while stock options represent 6% of compensation today, down from 10% five years ago. Cash accounts for 38% of director compensation, versus 39% in 2011.

95% of the independent chairmen of S&P 500 boards receive an additional fee, averaging $165,112. Nearly two-thirds of lead and presiding directors, 65%, receive additional compensation. The average premium paid to lead and presiding directors is $33,354.

Investor attention to board performance and governance continues to escalate, and, increasingly, it’s large institutional investors—so-called “passive” investors—who are making known their expectations in areas such as board composition, disclosure and shareholder engagement. Long-term investors have shifted their posture to taking positions on good governance, and are increasingly demonstrating common ground with activists on governance topics.

Board composition is a particular area of focus, as traditional institutional investors have become more explicit in demanding that boards demonstrate that they are being thoughtful about who is sitting around the board table and that directors are contributing. They are looking more closely at disclosures related to board refreshment, board performance and assessment practices, in some cases establishing voting policies on governance.

Boards are taking notice. Directors want to ensure that their boards contribute at the highest level, aligning with shareholder interests and expectations. In response, boards are enhancing their disclosures on board composition and leadership, reviewing governance practices and establishing protocols for engaging with investors. Here are some of the trends we are seeing in the key areas of investor concern.

Board composition

The composition of the board—who the directors are, the skills and expertise they bring, and how they interact—is critical for long-term value creation, and an area of governance where investors increasingly expect greater transparency. Shareholders are looking for a well-explained rationale for why the group of people sitting around the board table are the right ones based on the strategic priorities of the business. They want to know that the board has the processes in place to review and evolve board composition in light of emerging needs, and that the board regularly evaluates the contributions and tenure of current board members and the relevance of their experience.

Acknowledging investor interest in their composition, more boards are reviewing how to best communicate their thinking about the types of expertise needed in the board—and how individual directors provide that expertise. More than one-third of the 96 corporate secretaries responding to our annual governance survey, conducted each year as part of the research for the Spencer Stuart Board Index, said their board has changed the way it reports director bios/qualifications; among those that have not yet made changes, 15% expect the board to change how they present director qualifications in the future.

What’s happening to board composition in practice after all of the talk about increasing board turnover? In 2016, we actually saw a small decline in the number of new independent directors elected to S&P 500 boards. S&P 500 boards included in our index elected 345 new independent directors during the 2016 proxy year—averaging 0.72 new directors per board. Last year, S&P 500 boards added a total of 376 new directors (0.78 new directors per board).

Nearly one-third (32%) of the new independent directors on S&P 500 boards are serving on their first outside corporate board. Women account for 32% of new directors, the highest rate of female representation since we began tracking this data for the S&P 500. This year’s class of new directors, however, includes fewer minority directors (defined as African-American, Hispanic/Latino and Asian); 15% of the 345 new independent directors are minorities, a decrease from 18% in 2015.

With the rise of shareholder activism, we’ve also seen an increase in investors and investment managers on boards. This year, 12% of new independent directors are investors, compared with 4% in 2011 and 6% in 2006.

Independent board leadership

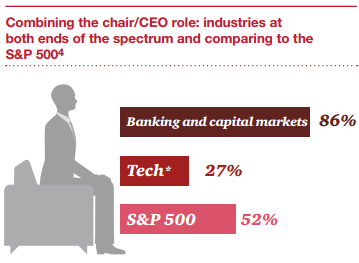

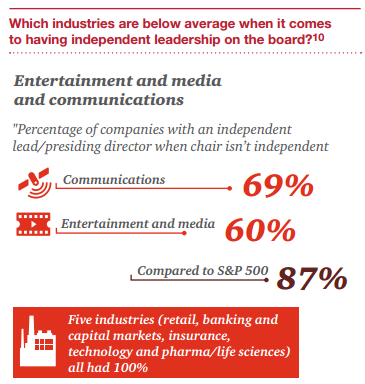

Boards continue to feel pressure from some shareholders to separate the chair and CEO roles and name an independent chairman. And, indeed, 27% of S&P 500 boards, versus 21% in 2011, have an independent chair. An independent chair is defined as an independent director or a former executive who has met applicable NYSE or NASDAQ rules for independence over time. This actually represents a small decline from 29% last year. Meanwhile, naming a lead director remains the most common form of independent board leadership: 87% of S&P 500 boards report having a lead or presiding director, nearly all of whom (98%) are identified by name in the proxy.

In our governance survey, 12% of respondents said their board has recently separated the roles of chairman and CEO, while 33% said their board has discussed whether to split the roles within the next five years. Among boards that expect to or have recently separated the chair and CEO roles, 72% cite a CEO transition as the reason, while 20% believe the chair/CEO split represents the best governance.

In response to investor interest in board leadership structure—and sometimes demands for an independent chairman—more boards are discussing their leadership structure in their proxies, for example, explaining the rationale for maintaining a combined chair/CEO role and delineating the responsibilities of the lead director. Among the lead director responsibilities boards highlight: approving the agenda for board meetings, calling meetings and executive sessions of independent directors, presiding over executive sessions, providing board feedback to the CEO following executive sessions, leading the performance evaluation of the CEO and the board assessment, and meeting with major shareholders or other external parties, when necessary. Some proxies include a letter to shareholders from the lead independent director.

Tenure and term limits

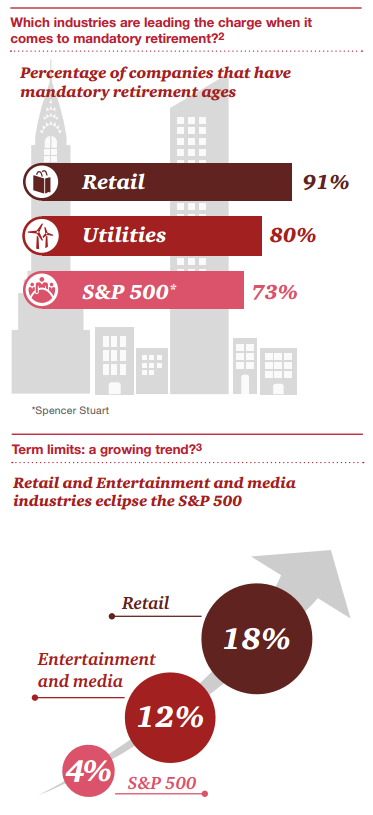

Director tenure continues to be a hot topic for some shareholders. While some rating agencies and investors have questioned the independence of directors with “excessive” tenure, there are no specific regulations or listing standards in the U.S. that speak to director independence based on tenure. And, in fact, most companies do not have governance rules limiting tenure; only 19 S&P 500 boards (4%) set an explicit term limit for non-executive directors, a modest increase from 2015 when 13 boards (3%) had director term limits.

Just 3% of survey respondents said their boards are considering establishing director term limits, but many boards are disclosing more in their proxies about director tenure. Specifically, boards are describing their efforts to ensure a balance between short-tenured and long-tenured directors. And several companies have included a short summary of the board’s average tenure accompanied by a pie chart breaking down the tenure of directors on the board (e.g., directors with less than five years tenure, between five and 10 years, and more than 10 years tenure on the board).

Among S&P 500 boards overall, the average board tenure is 8.3 years, a slight decrease from 8.7 five years ago. The median tenure has declined as well in that time, from 8.4 to 8.0. The majority of boards, 63%, have an average tenure between six and 10 years, but 19% of boards have an average tenure of 11 or more years.

We also looked this year at the tenure of individual directors: 35% of independent directors have served on their boards for five years or less, 28% have served for six to 10 years, and 22% for 11 to 15 years. Fifteen percent of independent directors have served on their boards for 16 years or more.

Mandatory retirement

In the absence of term or tenure limits, most S&P 500 boards rely on mandatory retirement ages to promote turnover. About three-quarters (73%) of S&P 500 boards report having a mandatory retirement age for directors. Eleven percent report that they do not have a mandatory retirement age, and 16% do not discuss mandatory retirement in their proxies.

Retirement ages have crept up in recent years, as boards have raised them to allow experienced directors to serve longer. Thirty-nine percent of boards have mandatory retirement ages of 75 or older, compared with 20% in 2011 and just 9% in 2006. Four boards have a retirement age of 80. The most common mandatory retirement age is 72, set by 45% of S&P 500 boards.

As retirement ages have increased, so has the average age of independent directors. The average age of S&P 500 independent directors is 63 today, two years older than a decade ago. In that same period, the median age rose from 61 to 64. Meanwhile, the number of older boards has increased; 37% of S&P 500 boards have an average age of 64 or older, compared with 19% a decade ago, and 15 of today’s boards (3%) have an average age of 70 or greater, versus four (1%) a decade ago.

Board evaluations

Another topic on which large institutional investors have become more vocal is board performance evaluations. Shareholders are seeking greater transparency about how boards address their own performance and the suitability of individual directors—and whether they are using assessments as a catalyst for refreshing the board as new needs arise.

We have seen a growing trend in support of individual director assessments as part of the board effectiveness assessment—not to grade directors, but to provide constructive feedback that can improve performance. Yet the pace of adoption of individual director assessments has been measured. Today, roughly one-third (32%) of S&P 500 boards evaluate the full board, committees and individual directors annually, an increase from 29% in 2011.

In our survey of corporate secretaries, respondents said evaluations are most often conducted by a director, typically the chairman, lead director or a committee chair. A wide range of internal and external parties are also tapped to conduct board assessments, including in-house and external legal counsel, the corporate secretary and board consulting firms. Thirty-five percent use director self-assessments, and 15% include peer reviews. According to proxies, a small number of boards, but more than in the past, disclose that they used an outside consultant to facilitate all or a portion of the evaluation process.

Shareholder engagement

In light of investors’ growing desire for direct engagement with directors, more boards have established frameworks for shareholders to raise questions and engage in meaningful, two-way discussions with the board. In addition to improving disclosures about board composition, assessment and other key governance areas, some boards include in their proxies a summary of their shareholder outreach efforts. For example, they detail the number of investors the board met with, the issues discussed and how the company and board responded. A few boards facilitate direct access to the board by providing contact information for individual directors, including the lead director and audit committee chair.

Going further, many boards now proactively reach out to their company’s largest shareholders. In our survey, 83% of respondents said management or the board contacted the company’s large institutional investors or largest shareholders, an increase from 70% the year prior. The most common topic about which companies engaged with shareholders was proxy access (52%), an increase from 33% in 2015. Other topics included “say on pay” (51%), CEO compensation (40%), director tenure (30%), board refreshment (27%), shareholder engagement approach (27%) and chairman independence (24%). Survey respondents also wrote in more than a dozen additional topics, including majority/cumulative voting, disclosure enhancements, environmental issues and gender pay equity.

Enhancing board performance

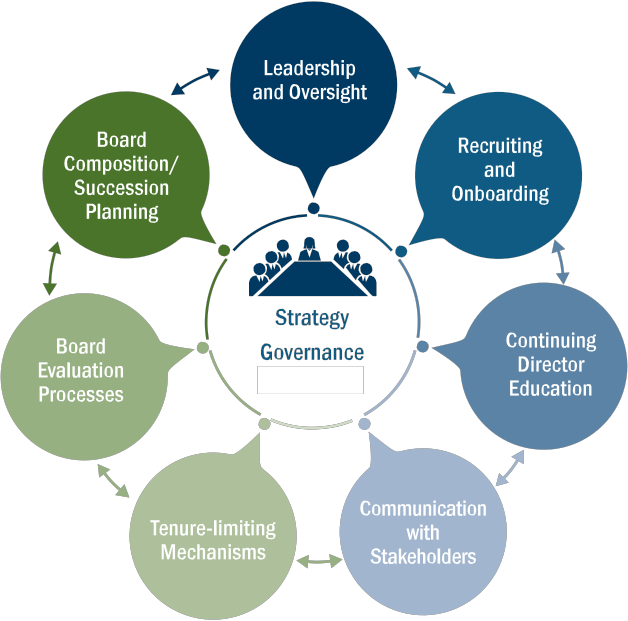

The topic of board refreshment can be a highly charged one for boards. But having the right skills around the table is critical for the board’s ability to provide the appropriate guidance and oversight of management. Furthermore, the capabilities and perspectives that a board needs evolve over time as the business context changes. Boards can ensure that they have the right perspectives around the table and are well-equipped to address the issues that drive shareholder value—which, after all, is what investors are looking for—by doing the following:

Viewing director recruitment in terms of ongoing board succession planning, not one-off replacements. Boards should periodically review the skills and expertise on the board to identify gaps in skills or expertise based on changes in strategy or the business context.

Proactively communicating the skill sets and expertise in the boardroom—and the roadmap for future succession. Publishing the board’s skill matrix and sharing the board’s thinking about the types of expertise that are needed on the board—and how individual directors provide that expertise—signals to investors that the board is thoughtful about board succession.

Setting expectations for appropriate tenure both at the aggregate and individual levels. By setting term expectations when new directors join, boards can combat the perceived stigma attached to leaving a board before the mandatory retirement age. Ideally, boards will create an environment where directors are willing to acknowledge when the board would benefit from bringing on different expertise.

Thinking like an activist and identifying vulnerabilities in board renewal and performance. Proactive boards conduct board evaluations annually to identify weaknesses in expertise or performance. They periodically engage third parties to manage the process and are disciplined about identifying and holding themselves accountable for action items stemming from the assessment.

Establishing a framework for engaging with investors. This starts with proactive and useful disclosure, which demonstrates that the board has thought about its composition, performance and other specific issues. In addition, it is valuable to have a protocol in place enumerating responsibilities related to shareholder engagement.