Plusieurs experts de la gouvernance des sociétés cotées se demandent ce qu’il adviendra de la législation Dodd-Frank Act, sachant que Donald Trump a promis d’effectuer un démantèlement presque total de cette réglementation qui a été mise en place à la suite de la crise financière de 2007-2008.

L’avenir nous dira ce que nous réservent les « nouvelles » règles de gouvernance prônées par la nouvelle administration américaine.

Évidemment, la réglementation canadienne, toujours très liée à celle de la SEC, devra s’ajuster, sans trop de heurts !

Bonne lecture ! Vos commentaires sont appréciés des lecteurs.

During his campaign, Donald Trump promised a near-dismantling of the Dodd-Frank Act, the core piece of financial reform legislation enacted following the 2007-2008 financial crisis. He doubled down on that promise once in office, vowing to both “do a big number” on and give “a very major haircut” to Dodd-Frank. In early February, he took the first step in fulfilling this dangerous promise by signing an executive order directing U.S. Secretary of the Treasury Steve Mnuchin to conduct a review of Dodd-Frank. Per the executive order, Secretary Mnuchin will present the findings in early June. While the country waits for President Trump’s plan, it is useful to analyze one prominent way Trump and Congress might choose to gut financial reform—through the Financial CHOICE Act, or FCA.

Introduced in the last Congress by U.S. House of Representatives Financial Services Committee Chairman Jeb Hensarling (R-TX) and expected to be reintroduced in the coming weeks, the Financial CHOICE Act offers a blueprint for how Trump might view these issues. During the presidential campaign, Rep. Hensarling briefed Trump on his ideas regarding financial deregulation and was reportedly on Trump’s short list for treasury secretary. The FCA would deregulate the financial industry and put the U.S. economy in the same perilous position it was in right before the 2007–2008 financial crisis. The precrisis regime of weak regulation and little oversight created an environment of unchecked financial sector risk and widespread predatory consumer practices, which precipitated the Great Recession and brought the U.S. economy to the brink of collapse. And the argument repeated by President Trump and other advocates of financial deregulatory proposals—that bank lending has been crushed under the weight of financial regulations over the past six years—has been thoroughly debunked by bank lending data.

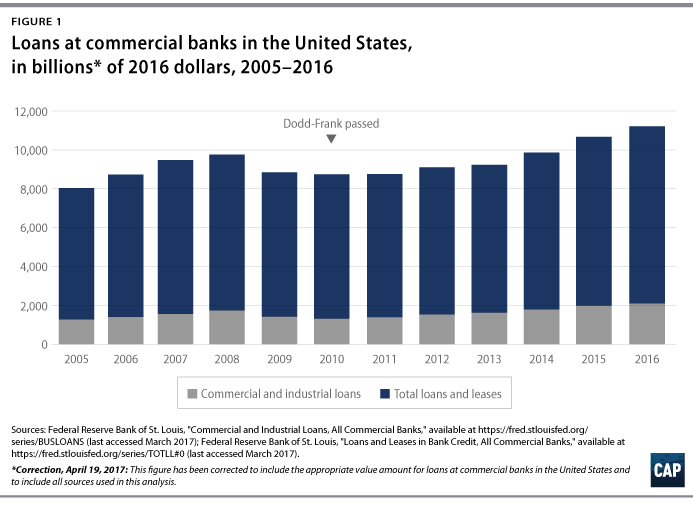

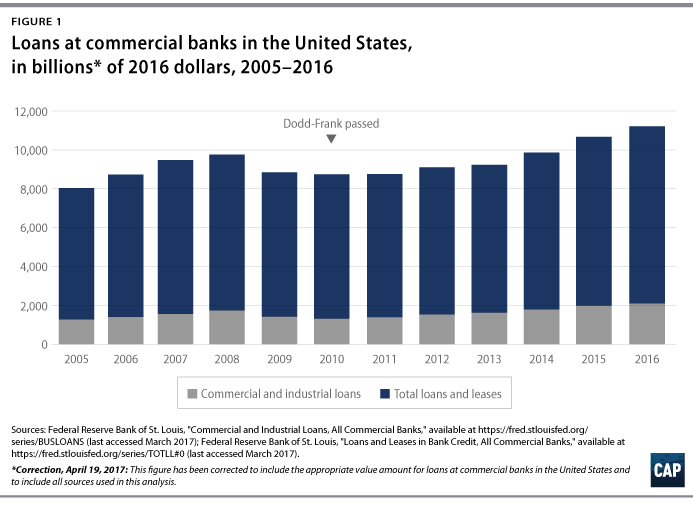

Before delving into the specifics of the Financial CHOICE Act, it is helpful to put Rep. Hensarling’s deregulatory efforts in context. To justify dismantling financial reform, President Trump and his congressional allies know that they must outline a problem. President Trump argues that the main problem with financial reform is bank lending. He believes that banks are not making enough loans due to the burdens of Dodd-Frank. What is his evidence? Nothing more than anecdotal remarks that his friends cannot get loans. As Figure 1 demonstrates, a lack of loans is simply not the case. Overall lending and business lending in particular, has increased significantly since the financial crisis and the passage of Dodd-Frank. Moreover, credit card lending, auto lending, and mortgage lending have increased since 2010, when Dodd-Frank was passed. Bank profits are also higher than ever.

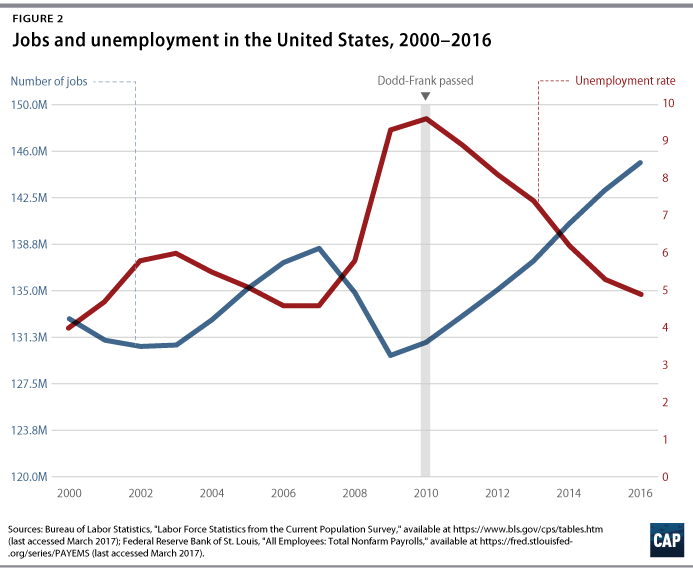

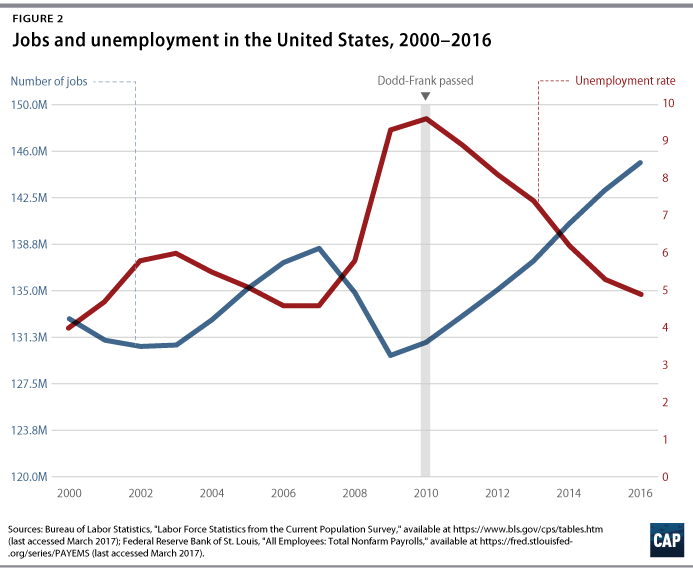

Chairman Hensarling makes similar arguments about the perceived unavailability of credit, adding that financial reform has not encouraged economic growth and has hurt community banks. Again, the data contradict these charges. Figure 2 highlights the steady economic growth the country experienced under President Barack Obama. And while the scars of the devastating Great Recession remain, the financial reforms put in place to prevent the recurrence of exactly that kind of economic catastrophe have not damaged growth. Indeed, since the end of the financial crisis and the passage of Dodd-Frank, community bank lending and profitability are both up. It is fair to say that the number of community banks has declined over time. This trend, however, started in the 1980s and is caused by economies of scale, technology, and long-running trends toward banking deregulation, as well as other factors—not the 2010 passage of the Dodd-Frank Act.

Hensarling presents his approach as a moderate adjustment to Dodd-Frank, but in reality it is a thorough demolition of financial reform. The complete publication (available here) analyzes how Hensarling’s approach erodes the financial stability safeguards that the real economy needs to thrive, from mitigation of systemic risk to financial sector accountability and consumer protection. It also explains how the bill further concentrates—and makes even more unaccountable—economic power in the hands of those that will serve their own interests at the expense of the real economy. Finally, the report details how the FCA eliminates the consumer and investor protections that guard against the predatory financial practices that wreaked havoc on consumers and investors prior to the financial crisis.

It is necessary to note that just about every provision in the report could fit under the rubric of financial stability safeguards. For example, consumer financial protection protects ordinary consumers from abuses and the broader financial system from the proliferation of dangerous consumer loans that can bring down entire firms and markets. Similarly, the Volcker Rule is a key bulwark against the high-risk bets that brought down major firms in 2008, and yet it also aims to reorient large bank trading toward real economy-serving purposes. The report discusses certain provisions under one section rather than another should not be taken as a substantive comment on the merit or usefulness of the provision to financial stability. The report’s different sections reflect an effort to highlight how the Dodd-Frank Act and financial reform yield a broad array of public benefits. Similarthe report highlights examples of broader themes in the FCA rather than focusing on minute details: Failure to discuss any particular provision should not be read as a substantive judgment regarding its relative merits.

The report is based on the version of the Financial CHOICE Act released in September 2016, as well as a memo outlining this year’s planned changes to that version. A new version, which may have some further modifications, is expected to be released in the coming weeks.

Financial reform enacted through the Dodd-Frank Act has made a lot of necessary progress since the crisis. U.S. banks have more substantial loss-absorbing capital cushions, increasingly rely on stable sources of funding, undergo rigorous stress testing, and plan for their orderly failure. President Trump’s intent to dismantle these reforms only helps Wall Street’s bottom line—ignoring the memory of every family who lost their home, every worker who lost his or her job, and every consumer who was peddled a toxic financial product.

The question remains: What is the problem President Trump and his allies in Congress are trying to solve? Lending is up. Bank profits are up. Consumer credit costs are down. The economy is steadily improving. Yes, much more needs to be done to make the economy work for hard-working Americans, but financial deregulation is not the path to that end. In fact, it is a path toward exactly the opposite: booms and busts that leave taxpayers holding the bag for Wall Street’s excesses, greater concentration of economic power and less accountability for wrongdoing that harms ordinary consumers and investors, and major changes to financial regulation and monetary policy that would damage the real economy. Now that is a problem.

The complete publication, including footnotes, is available here.

Endnotes

1Billy House and Kevin Cirilli, “Trump’s Dodd-Frank Plan Will Be Early Test of Republican Unity,” Bloomberg, May 19, 2016, available at https://www.bloomberg.com/politics/articles/2016-05-19/trump-s-dodd-frank-plan-will-be-early-test-of-republican-unity. (go back)

2Glenn Thrush, “Trump Vows to Dismantle Dodd-Frank ‘Disaster,’” The New York Times, January 30, 2017, available at https://www.nytimes.com/2017/01/30/us/politics/trump-dodd-frank-regulations.html?_r=0; Jessica Dye, “Trump vows ‘major haircut’ for Dodd-Frank,” Financial Times, April 4, 2017, available at https://www.ft.com/content/fb08a355-f7fc-3021-8c92-d94af9a2f35b. (go back)

3Executive Order no. 13,772, Code of Federal Regulations (2017), available at https://www.whitehouse.gov/the-press-office/2017/02/03/presidential-executive-order-core-principles-regulating-united-states. (go back)

4Ibid. (go back)

5Financial CHOICE Act of 2016, H. Rept. 5983, 114 Cong. 2 sess. (Government Printing Office, 2016), available at https://www.congress.gov/114/bills/hr5983/BILLS-114hr5983rh.pdf. (go back)

6Donna Borak, “Donald Trump, Jeb Hensarling Meet on Dodd-Frank Alternative,” The Wall Street Journal, June 7, 2016, available at https://www.wsj.com/articles/donald-trump-jeb-hensarling-meet-on-dodd-frank-alternative-1465335535; Damien Palette, Ryan Tracy, and Michael C. Bender, “Trump Team Considering Rep. Jeb Hensarling as Treasury Secretary,” The Wall Street Journal, November 10, 2016, available at https://www.wsj.com/articles/donald-trump-considering-rep-jeb-hensarling-as-treasury-secretary-1478812583. (go back)

7Jim Puzzanghera, “Trump says businesses can’t borrow because of Dodd-Frank. The numbers tell another story,” Los Angeles Times, February 26, 2017, available at http://www.latimes.com/business/la-fi-trump-bank-loans-20170226-story.html; Matt Egan, “Banks are lending a ton, despite Trump’s claims,” CNN Money, February 13, 2017, available at http://money.cnn.com/2017/02/13/investing/bank-business-lending-dodd-frank-trump/. (go back)

8Zeke Faux, Yalman Onaran, and Jennifer Surane, “Trump Cites Friends to Say Banks Aren’t Making Loans. They Are.,” Bloomberg, February 4, 2017, available at https://www.bloomberg.com/news/articles/2017-02-04/trump-cites-friends-to-say-banks-aren-t-making-loans-they-are. (go back)

9Kate Berry, “Four myths in the battle over Dodd-Frank,” American Banker, March 10, 2017, available at https://www.americanbanker.com/news/four-myths-in-the-battle-over-dodd-frank. (go back)

10Matt Egan, “American bank profits are higher than ever,” CNN Money, March 3, 2017, available at http://money.cnn.com/2017/03/03/investing/bank-profits-record-high-dodd-frank/. (go back)

11Jeb Hensarling, “After Five Years, Dodd-Frank Is a Failure,” The Wall Street Journal, July 19, 2015, available at https://www.wsj.com/articles/after-five-years-dodd-frank-is-a-failure-1437342607. (go back)

12Gregg Gelzinis and others, “The Importance of Dodd-Frank, in 6 Charts,” Center for American Progress, March 27, 2017, available at https://www.americanprogress.org/issues/economy/news/2017/03/27/429256/importance-dodd-frank-6-charts/. (go back)

13Ibid. (go back)

14Ylan Mui, “Memo from a key congressman outlines plan to gut Dodd-Frank bank rules,” CNBC, February 9, 2017, available at http://www.cnbc.com/2017/02/09/dodd-frank-hensarling-memo-reveals-plan-to-scrap-bank-regulations.html. (go back)

15Wall Street is not monolithic, and firms may have differing views on the provisions of the Financial CHOICE Act, but on the whole, this agenda is clearly aligned with the interests of financial institutions and not the American public.