Voici un article d’Eben Harrell paru dans le numéro de décembre 2016 de Harvard Business Review.

L’auteur affirme, basé sur plusieurs résultats de recherche, que les conseils d’administration ne sont pas préparés à assurer la relève du président-directeur général.

En effet, il appert que le roulement des fonctions de CEO s’accélère grandement (plus de 15 %) et que seulement la moitié des CA sont préparés à faire face aux conséquences.

On estime que 40 % des nouvelles recrues CEO ne peuvent répondre aux exigences de leurs tâches dans les 18 premiers mois !

Le remplacement d’un PDG peut prendre plusieurs mois, voire des années !

Doit-on recruter à l’interne ou recruter à l’externe ? Les recherches montrent que l’on a de plus en plus tendance à recruter les candidats à l’externe ; on parle de 20 % à 30 % du recrutement qui se fait à l’externe.

On constate que les conseils d’administration ne font pas les efforts nécessaires pour planifier la relève de leur CEO et que les coûts reliés à ces manquements sont considérables.

Bonne lecture !

Succession Planning: What the Research Says

All CEOs will inevitably leave office, yet research has long shown that most organizations are ill-prepared to replace them. In this article, we review the most salient studies of succession planning and offer context from experts on the process of picking new leaders for organizations.

Boards Aren’t Ready for Succession

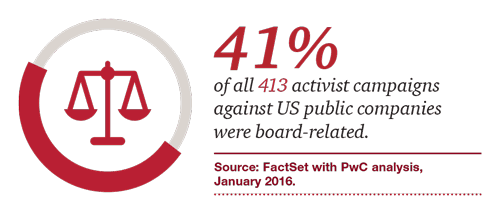

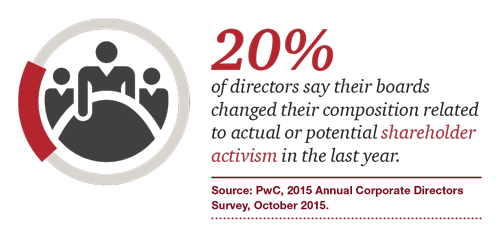

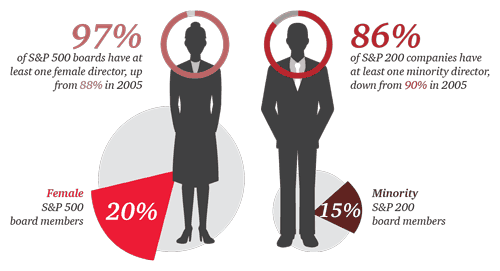

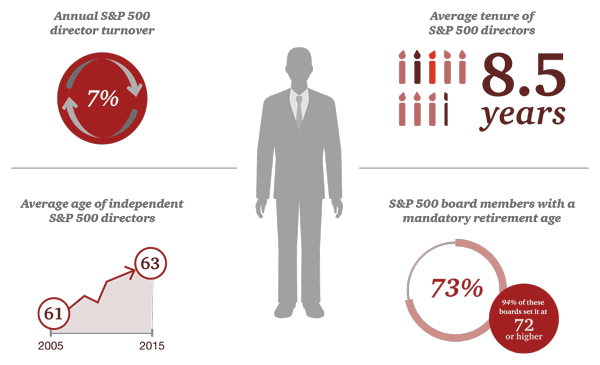

Each year about 10% to 15% of corporations must appoint a new CEO, whether because of executives’ retirement, resignation, dismissal, or ill health. In 2015, in fact, turnover among global CEOs hit a 15-year high. Activist investors are increasingly forcing out leaders they deem underperforming. Yet despite these trends, most boards are unprepared to replace their chief executives. A 2010 survey by the search firm Heidrick & Struggles and the Rock Center for Corporate Governance at Stanford University revealed that only 54% of boards were grooming a specific successor, and 39% had no viable internal candidates who could immediately replace the CEO if the need arose.

An organization’s top executive is one of the few variables over which boards have total control—and their failure to plan for CEO transitions has a high cost. A study of the world’s 2,500 largest public companies shows that companies that scramble to find replacements for departing CEOs forgo an average of $1.8 billion in shareholder value. A separate study reveals that the longer it takes a company to name a new CEO during a succession crisis, the worse it subsequently performs relative to its peers. Finally, poor succession planning often extends the tenure of ineffective CEOs, who end up lingering in office long after they should have been replaced. A study by Booz & Company found that, on average, firms with stock returns in the lowest decile underperformed their industry peers by 45 percentage points over a two-year period—and yet the probability that their CEOs would be forced out was only 5.7%. The authors commented that “boards are giving underperforming CEOs more latitude than might be expected.”

Lack of preparedness is only part of the problem, however. An equal challenge, the consultant Ram Charan wrote in 2005, is that all too often, “CEOs are being replaced badly.” Boards aren’t finding the right man or woman for the job. Estimates suggest that up to 40% of new CEOs fail to meet performance expectations in the first 18 months.

Planning Takes Years, Not Months

So what can directors do not only to prepare for succession events but to ensure they make a winning pick when the time comes? A first step is to integrate executive development programs with CEO succession planning so that the best internal candidates are identified early and flagged at the board level. The proof that such an approach works can be found in companies with prestigious leadership-training programs. Researchers at Santa Clara University and Indiana University who examined the track records of chief executives groomed at “CEO factories,” such as General Electric, IBM, and Procter & Gamble, found that the stock market reacted positively when they were appointed and that they delivered superior operating performance over the next three years. The researchers concluded that certain firms “are efficient in developing leadership skills” because “they are able to expose executives to a broad variety of industries and help them develop skills that can be transferred to different business environments.”

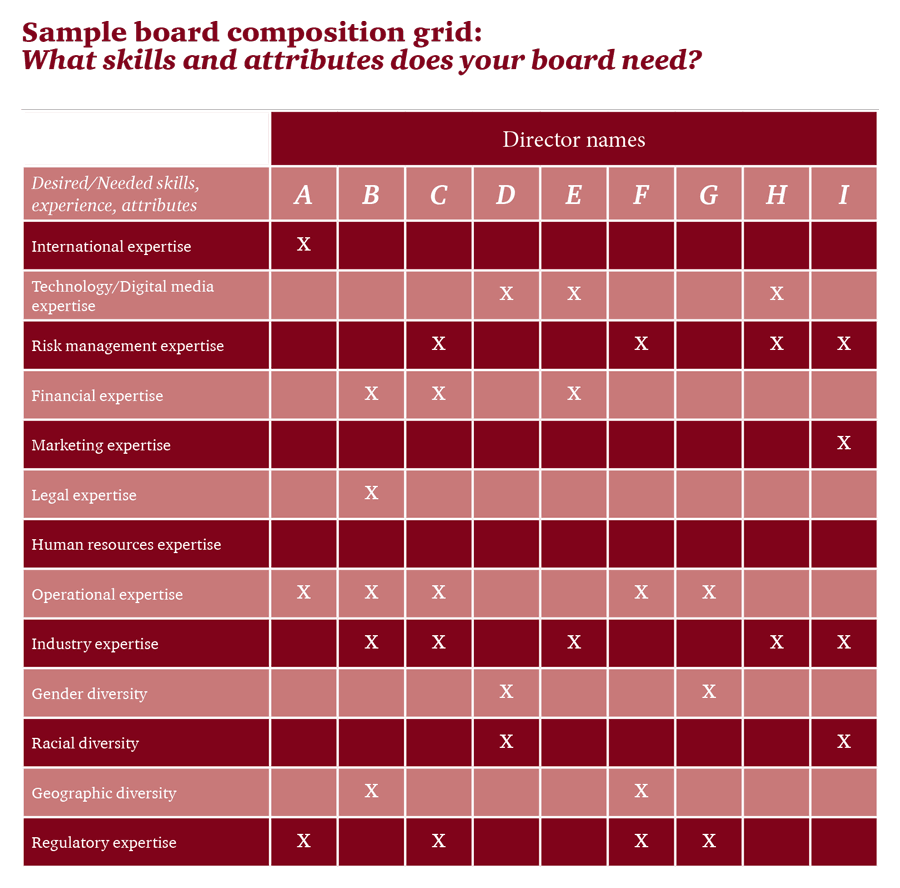

Internal grooming of promising executives can create value beyond the avoidance of costly interregnums. In his book Succession, Noel Tichy, a management professor at the Ross School of Business at the University of Michigan, argues that by putting potential successors in charge of new projects, companies can accelerate change while also testing candidates’ suitability for the top spot. Few boards of directors seize that opportunity, however. Research by the Conference Board, the Institute of Executive Development, and the Rock Center found that most directors lack detailed knowledge of the skills, capabilities, and performance of senior executives just one level below the CEO. Only 55% of directors surveyed in the study claimed to understand the strengths and weaknesses of those executives well or very well. Seventy-seven percent did not participate in the performance evaluations of their firm’s top executives other than the CEO. And only 7% of companies formally assigned a director to mentor senior executives below the CEO.

Some commentators believe this lack of involvement is the result of CEOs’ efforts to stymie boards: The absence of clear successors keeps incumbents in the job longer and gives them more bargaining power with boards. A packed governance agenda may also be to blame. When the consulting firm Mercer Delta surveyed directors about the amount of time they spent on nine key activities, a large majority reported devoting more and more hours to monitoring accounting, risk, and financial performance and other governance duties. Directors also indicated that they spent less time interacting with potential CEO successors than on any other activity.

Michael Useem, a professor of management at the University of Pennsylvania’s Wharton School, believes a shortage of directors with experience in hiring top executives also contributes to poor succession planning. He advocates for more current and former CEOs on boards. “People who know how to hire and manage top executives will better understand what a company needs in executive talent and which of the final candidates best brings that to the table,” he says.

In his book It’s Not the How or the What but the Who, Claudio Fernández-Aráoz of the search firm Egon Zehnder lays out six succession-planning guidelines for busy directors: First, start early, ideally the moment a new CEO takes charge. Second, create strict performance metrics and a process for evaluating the CEO against them. Third, identify and develop potential successors within the firm and then benchmark them against external talent. (Useem says directors can go deep during vetting by interviewing all the direct reports of the internal front-runners.) Fourth, look externally to widen the pool of candidates, through executive search firms that don’t use contingency arrangements or charge percentage fees (which Fernández-Aráoz believes create perverse incentives). Fifth, require the board to conduct periodic emergency succession drills. And finally, put in place an extensive transition process to help with onboarding, which is especially important given that 80% of CEO appointees have never served in a chief executive role before.

Insiders Versus Outsiders?

Boards often face a binary choice: Go with an internal candidate, or recruit an executive from another company? Traditionally, internal candidates favored by boards have progressed through positions with responsibility for larger and more complex P&L centers. They might start off by managing a single product and then move into an overseas “head of country” position before returning to the main corporate office to supervise a business unit and then run an entire division. Such a tightly choreographed internal trajectory is increasingly rare in a world of job hopping and frequent executive shuffles, however. Consider that in 1988, an executive typically worked for fewer than three employers in his or her lifetime; 10 years later the average had risen to more than five.

Increasingly, CEO vacancies are being filled by external candidates. In 2013, 20% to 30% of boards chose to replace an outgoing CEO with an external hire. In contrast, just 8% to 10% of newly appointed CEOs at S&P 500 companies were outsiders during the 1970s and 1980s.

This trend toward external hires has been strongly criticized by some scholars, including Harvard Business School’s Rakesh Khurana, who argues in his book Searching for a Corporate Savior that too often boards hire charismatic outsiders even when their experience and abilities are not right for companies’ needs. He also blames high-priced executive search firms for driving up demand for external candidates and censures the business press and the investor community for helping fuel what he calls “the cult of the outsider.”

Khurana may have a point: Candidates that are headhunted from other firms are paid more than internally promoted candidates. According to the executive-compensation research firm Equilar, the median pay of CEOs who are outsiders is $3.2 million more than the median pay of insiders. Far from deserving such a premium, externally appointed CEOs seem to underperform their internally promoted counterparts over the long run. A 2010 study by Booz & Company found that insider CEOs had delivered superior market-adjusted shareholder returns in seven out of the preceding 10 years. And Gregory Nagel of Middle Tennessee State University and James Ang of Florida State University used elaborate multiple regression analyses to show that, on average, going outside the company to fill the top office was justified in just 6% of cases.

These studies might not be capturing the whole picture, however. Companies tend to look outside their own ranks for leaders when recent financial results are poor, which suggests that external hires might struggle simply because they’re walking into challenging conditions at underperforming companies. What’s more, multiple studies have concluded that the CEO’s influence on corporate performance pales in comparison with other, uncontrollable effects—which is to say, it’s very hard to ascertain if a CEO is lucky or good. Furthermore, studies indicate that outsiders who join the company three to four years before they become CEO do just as well as insiders with much more experience at the firm, a crossover category of executive that Harvard Business School’s Joseph Bower calls “inside-outside” leaders. For these and other reasons, says David Larcker, a professor at Stanford Business School, “it is difficult to conclude whether internal or external candidates are systematically better operators.”

What Are the Traits of a Great CEO?

Whether they’re searching for a successor in a firm’s internal ranks or an external pool, directors would benefit from knowing which qualities best predict success in the top job. Unfortunately, while much ink has been spilled on the topic of individual leadership, very little of it can be scientifically supported. In an influential book published in 1991, the University of San Diego’s Joseph Rost pointed out that writers had defined leadership in more than 200 ways since 1900, often with nothing but conjecture or personal experience to back up their claims. That’s slowly changing as researchers look for correlations between personal biographies and leadership success. For instance, one study found that CEOs who had previously served on the boards of large public companies seemed to outperform those without such experience. Another study found that CEOs with military backgrounds were less likely to engage in fraudulent activity. Yet another found that CEOs who spent lavishly in their personal lives were more likely to oversee corporations with loose internal financial controls. Age may also be relevant: Researchers at Mississippi State and the University of Missouri found that younger CEOs outperformed their older counterparts, even after accounting for the fact that younger CEOs were more likely to work in fast-growing industries such as technology. And charismatic CEOs seemed to outperform during periods of upheaval and uncertainty but provided no boost during more stable times.

The private equity industry, which has vast experience hiring CEOs, may also offer some clues about what qualities make for strong CEOs. A recent survey of managing partners at 32 firms found that when choosing a chief executive, they paid less attention to attributes such as track record and industry experience and gave more weight to softer skills such as team building and resilience. But the PEs valued urgency much more highly than empathy—a finding more in keeping with a separate assessment of CEO personalities at venture-backed and private-equity-owned corporations, which suggested that attributes having to do with execution (such as speed, aggressiveness, persistence, work ethic, and high standards) were more predictive of strong performance than interpersonal strengths (such as listening skills, teamwork, integrity, and openness to criticism).

While intriguing, the attempt to find the traits of the ideal CEO-in-waiting is still in its infancy. No one has yet disproved the view of legendary management scholar Peter Drucker, who wrote that successful executives “differ widely in their personalities, strengths, weaknesses, values, and beliefs. All they have in common is that they get the right things done.” While we may be a long way from building a predictive algorithm that can identify the perfect CEO successor, researchers have shown that there still remains a great deal more that boards could do to improve their succession planning—starting (in many cases) with having a plan in the first place.